Half empty? Half full?

How to invest in recovery mode

Is it too good to be true? Just nine short months ago, many were bracing for a long fall into a dark economic hole. But, the plunge seem to have been broken, markets have landed on their feet and are starting to rebound. Macroeconomic data is improving in some countries around the globe.

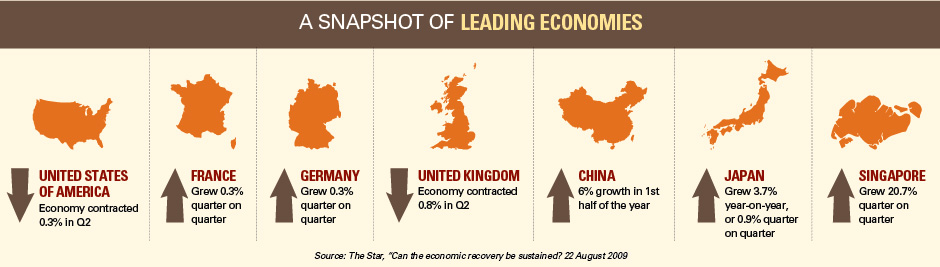

In fact, International Monetary Fund (IMF) Chief Economist Olivier Blanchard declared, “The recovery has begun” and went on to name Germany, France and Japan as countries that have already emerged from recession since the second quarter of this year.1

More so in Asia, good news seems to be flowing. “Across Asia, bridges are being built hard and fast, and various policies aim to sustain demand. The region, in fact, boasts a fiscal stimulus nearly twice as large as in other parts of the world. And the money goes further: with no cash being diverted to clean up ailing banks, all the funds go straight to healing demand,” reports HSBC Asian Economics in the third quarter 2009 issue. “The region’s financial systems were left largely unharmed by the calamities engulfing the West. After interest rates were chopped to record low, abundant liquidity now floating around Asia is gradually starting its quiet work. Already, asset prices are rising and consumption is coming back. To be sure, the process is most notable in China. But others are following, too: Singapore, Hong Kong, Taiwan, Korea, and Indonesia are feeling buoyant as well. India, too, has nudged out growth far stronger than many had believed.”2

Back home, Minister in the Prime Minister’s Department, Tan Sri Nor Mohamed Yakcop also says that the worst of the world economic crisis is over. The country’s economic growth in the second half of the year is expected to be better than the first half, though he cautions against expecting a quick recovery. It would be U-shaped rather than a V-shaped recovery. He predicts a long but hopefully ascending journey.3

Nevertheless, investing in Asia is not without its risks. Inflation may perk up and deal a blow to growth. The weak growth in US and Europe remains worrying. And of course there is the lingering question of what will happen when the stimulus money dries up and demand for exports from the West continues to be anemic?

That is the nature of investments – a delicate balance of possible risk and potential gain in one. It is up to the investor to regard the economic cup as half full or half empty and perhaps more importantly, whether it is worth drinking from. Nevertheless, no matter how you see it, we have some suggestions that could make both views much easier to swallow.

Half empty?

Take small sips regularly.

- You feel pessimistic about the recovery, wondering whether it is all hype and if it is sustainable.

- You may be fearful about making new investments.

- In such a view, think long term. You could potentially gain more if you stay invested throughout the highs and lows.

- Consider adopting a disciplined approach to investing so as to take your emotions out of the equation. You may want to consider opting for regular investments in more balanced investment vehicles such as Unit Trusts.

- You may want to choose investments that provide 100% capital protection to ensure peace of mind.

- Do be open to new information on the markets as they are always changing. It is best not to blindly cling to previous views that may blindside you to new opportunities.

Half full?

Fill up from different cups.

- You feel optimistic about the recovery and think that things will get better soon.

- You may be excited that the market is moving up again.

- You are open to making new investments to capture new markets and opportunities.

- In such a view, do not let your optimism run ahead of you. It is easy to fall into ‘herd mentality’, blindly following the crowd or market rumours.

- Read up on your intended investment, do your research and talk to your Relationship Manager about the risks and potential gains.

- Spread your ‘eggs’ to different baskets. It is prudent to maintain a diversified portfolio to ensure that you are not overly exposed to movements in any one asset class.

Source:

1. The Star, “Can the economic recovery be sustained?”22 August 2009.

2. HSBC Asian Economics, “Can Asia go the distance? Summary.” Third quarter 2009.

3. The Star, “Growth in H2 to be better than H1”, 11 August 2009.

LIKE THIS ARTICLE?

LIKE THIS ARTICLE?