Investing in 2009: A return to timeless investment wisdom

The investment climate from the last quarter of 2008 to the present has been a challenging one. The potent mix of a financial crisis and a global economic slowdown threw a powerful punch that left many asset classes staggering with double-digit declines. The first quarter of 2009 is over but uncertainties are expected to remain.

.

Although government initiated stimulus plans are in place, the ripple effect from the crisis is beginning to trickle into other aspects of the economy. With most developed countries in recession, global economic growth is expected to slow to its weakest pace in decades. Despite the situation, there is a silver lining.

The extremely low valuations have created many investment opportunities. Investors who remain calm and sharp may still be able to pick out good bargains to further their investment goals. Here are some evergreen investment strategies to help you invest with more confidence in 2009.

1. Understand what you buy

The guiding principle of investment is to understand what you are buying. Investing in simple products with transparent structures can help provide assurance that there are no nasty surprises lurking. When you buy into investments too complicated to be fully understood, you may be caught by unknown risk factors and incur significant losses should things go bad.

2. Use cash to your advantage

With the current market scenario, investors may instinctively keep a large portion of their assets in cash. While bank deposits provide security and liquidity, the rates of return they provide are often lower in comparison to other investment opportunities. With growing inflation, keeping your money in a bank deposit account may not necessarily be the best way to manage your money.

A smarter move would be to determine how much you should maintain in deposit accounts to be used as ‘operating capital’ or ‘emergency funds’. Then, the balance can be portioned as ‘strategic funds’. These funds can be invested in investment products that may offer higher returns without costing too much in terms of risk or accessibility. You may want to consider certain Structured Investment products which protect your principal amount when held to maturity. This will help lessen exposure to risks and gain potentially higher returns than bank deposits.

3. Use an averaging strategy to your benefit

One effective averaging strategy which can get your money working harder is Dollar Cost Averaging. Do bear in mind that this strategy does not automatically lessen volatility or promise higher returns as these factors are determined by market forces. It does, however, provide a disciplined approach to saving and investing for the long term.

Dollar Cost Averaging (DCA) Strategy

Investors have three major concerns when buying stocks: making a profit on their investment, minimizing risk, and the actual rate of return they will receive (including any dividend income). Ideally, there would be windfall profits in record time with no risk. In the real world, however, investors must use strategies that match both their resources and skill level. The Dollar Cost Averaging strategy is a great approach for people new to equity or unit trust investing since it minimizes risk and trends towards sound profitability especially in the longer term.

What is Dollar Cost Averaging (DCA)?

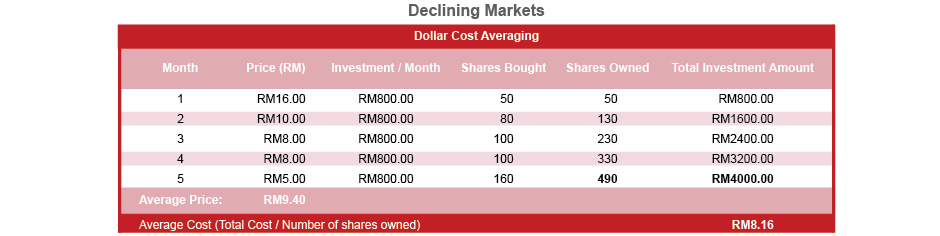

Dollar Cost Averaging is simply investing a regular sum of money over a specific time period. In today’s fluctuating markets, knee jerk responses are common with equity investments, especially for beginners. One bad earnings report can send stock prices tumbling and cause investors to panic and sell off their shares, which may further lower the prices. However, if a person were to keep their stocks and still continue to buy at regular intervals, the average price of the stock should continually approach the current market value at the time of purchase at each interval. Temporary fluctuations in pricing should be evened out. While the stock price may be lower than the initial investment value, the ability to acquire more shares at a lower price means that the short-term decrease in average stock prices should be balanced out when the share price increases. Please see an illustration from the chart below.

In this illustration, you may wish to invest RM4000 but instead of buying one lump sum into any equity unit trust fund, you spread out the payments little by little (e.g. RM800 every month) over the course of 5 months. DCA helps reduce the risk of locking in your investment at a specific price and incurring possible loss for downturn markets. By buying over the course of time, you average out the cost per unit.

Why use DCA?

DCA works well as you do not need to observe market ups and downs. When prices are high, you get fewer units. When prices are low, you gain more units. Over time, you may end up with more shares at lower prices than you would have if you had purchased them all at one go. It is also a systematic way to save and stay invested regardless of the market cycle.

What do I need to do before using DCA?

1. The very first step in planning to use this strategy is to determine how how much you can realistically afford to invest over an extended period of time. This is very important because the strategy will not reduce risk of loss effectively unless the investment amount is consistent. You will not insulate yourself against losses as effectively when a large initial investment is made and then followed by increasingly smaller amounts. In such a scenario, the gap between the average stock price and current market value will be larger and the risk for loss will be greater within the short term.

2. The next step should be to choose and research your investments carefully. Remember, you need to stay with this investment for many years for the strategy to be effective. An investor will suffer a dreadful loss if they purchase an underperforming stock that does not recover. For this reason, combining the benefits of Dollar Cost Averaging strategy with diversification and intensive research on the chosen investment is a prudent approach towards minimizing the risks in your portfolio.

3. Finally, pick an interval that you can be consistent with for years into the future. A weekly interval will work but it is probably best to make it monthly or even quarterly. Longer intervals are better because they reduce the expense of multiple transaction fees and also allow you to buy larger numbers of stock with each purchase.

Invest with ease

DCA can be easily incorporated into your investments. Just ask your Relationship Manager to set up a simple Standing Instruction to transfer a monthly sum on a set date from your bank account to your investment. And that’s it.

Another regular, systematic investment option is the HSBC PowerVantage Plus plan where you can gain potentially higher returns and enjoy the 3-in-1 benefits of a savings, investment and protection plan. Monthly deposits start from as low as RM300 per month with a choice of 3 or 5 year plans.

Investing in 2009 may be riskier than the bullish years past. But waiting passively for the market to turn around may not be the wisest option. Staying invested, even with small regular amounts, may be the way to average out cost and shore up gains when the market goes up again, eventually.

To learn more about how to invest with confidence, please contact your Relationship Manager.

April 2009

LIKE THIS ARTICLE?

LIKE THIS ARTICLE?