Optimism

Is it making a return to the economy?

Almost a year after the global credit crisis burst onto the scene with its barrage of doom-and-gloom headlines, things are beginning to look a little rosier, at least, that is what Malaysians are seeing.

The Malaysian Consumer Sentiment Index (CSI) crossed the 100 Index points threshold in a survey in July 2009 by the Malaysian Institute of Economic Research (MIER), up 26.9 points from the last quarter. The CSI measures consumers’ attitudes towards the economy. It surveys their confidence about their individual financial situation and the overall economic situation in the present and in the future.

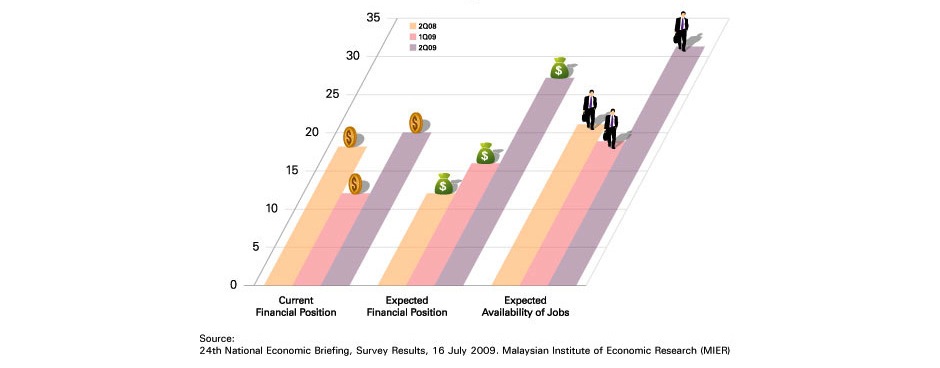

In MIER’s latest CSI survey, Malaysian consumers are showing signs of growing optimism compared to the last quarter. All three key components used to measure CSI – current financial position, optimism over future financial position and sentiments regarding the near term job market were all up. The big gainer is consumers’ perception of the job market, with over 30% of respondents agreeing to the statement that the job market would improve in the near term, compared to less than 20% in the first quarter.1

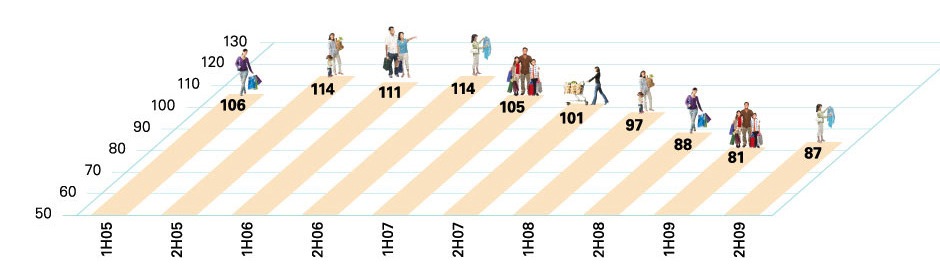

First upturn in 5 years

This is a marked turnaround for Malaysian consumer sentiment which, just a quarter ago, was still languishing in all-time lows. Another measure of consumer sentiment is the Nielsen Global Consumer Confidence Index (CCI). This index also records this upturn which in fact is the first since 2006. In its survey for second quarter 2009, Malaysian consumer confidence courageously clawed its way up from 81 in first quarter 2009 to 87 Index points.2 Considering the impact of the global credit crunch and subsequent effect on Asian economies, it is encouraging indeed that Malaysians are seeing the silver lining

amidst it all.

Confidence may affect you and your business

So, do these numbers matter? More than you think. According to Investopedia, the CCI yields valuable data on consumer spending habits. In simpler terms, when consumer confidence is up, optimism rises as well. Consumers are more likely to spend money which in turn fuels the economy. When confidence plunges, consumers may take a cautious stance and prefer to save than spend. These trends may prove useful to policy makers, investors, manufacturers, retailers, banks and others.3

For example, if you are a manufacturer and you see consumer confidence trending up, you may work towards adjusting your production levels and inventories. Or if confidence is dropping, a retailer may then consider promotions or price cuts to boost sales. However, do bear in mind that the CCI is a lagging indicator, somewhat like an economic rearview mirror. The numbers do not tell us what is going to happen but what has happened and to confirm whether a pattern is occurring.

A peek into MIER’s CSI survey shows that, in line with the optimistic trend, one in five respondents feel more positive about spending money. Generally, households are more confident about parting with their money. Not surprisingly, it is the big ticket items, which may have previously been put on a wait-and-see freeze, that are moving. New cars and PCs are at the top of consumers’ wish list. Property in the central, northern and urban areas may also register more demand, with the corresponding increase in demand for furniture.1

Optimism and the stock market

So where did this new found optimism come from? With the stock market performance in Malaysia intrinsically linked to consumer optimism, the recent cheer in the stock market have given reasons for some hurray.

The Edge reports that the MSCI Asia ex-Japan Index has risen 33.7% in second quarter 2009 alone. The FTSE Bursa Malaysia Kuala Lumpur Composite Index (FBM KLCI), often used as the benchmark for Bursa Malaysia has also gained 23.2% during the same period.4

“When consumer confidence is up, people are more likely to spend money which in turn fuels the economy.”

Nielsen’s survey says, “Stock market gains in the BRIC (Brazil,Russia, India & China) and Asian markets have also had a major impact on consumer confidence. More than any other region, stock markets in Asia have rallied and property prices are starting to regain their pre-recession values. Russia’s stock market is up 60 percent from the start of the year and Taiwan is up over 50 percent. Brazil and Singapore’s stock markets have gained around 40 percent in the past six months and the South Korea and Hong Kong stock markets are up over 30 percent.” It is no wonder then, that 7 of 10 most confident countries are found in Asia Pacific, with Indonesia and India tied at 113 Index points, followed by the Philippines (103), Brazil (96), Australia (95), China (94), United Arab Emirates (93), Canada (90), New Zealand (89) and at No. 10, our neighbour down south, Singapore (87).2

Seeing the light

The optimism is also buoyed by the belief that we are nearing the end of this long and dark economic tunnel. Ginger Snyder, Executive Vice President at Raymond James, a leading full-service investment firm in the United States, says that in some cases perception, in this case having a positive outlook, can help create reality. “I think the consumer wants to be optimistic,” she says. “They’re tired of being beaten up over the last year and looking for a glimmer of hope that things will be OK.”5

So if the indexes are anything to go by, better days may not be too far off.

% Responded ‘better’

Consumer Confidence Index trending for Malaysia since 2005

Source: Nielsen Global Consumer Confidence 1st Half 09 & 2nd Half 09

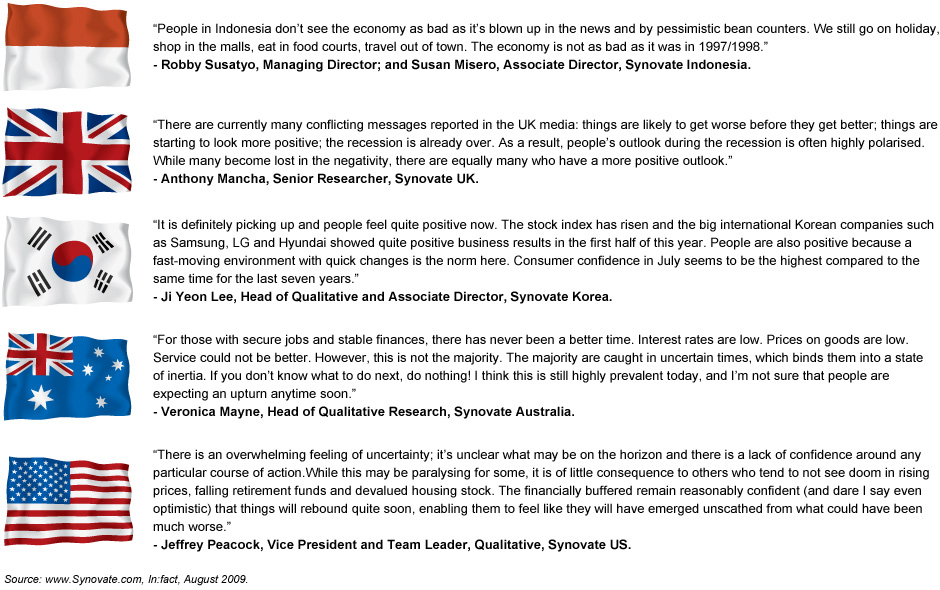

Sentiment around the world

How are people feeling about the Economy now?

For a better feel of the markets, here are some excerpts of comments by Synovate’s qualitative researchers on key markets.

October 2009

LIKE THIS ARTICLE?

LIKE THIS ARTICLE?