How did it all go bust

Months have passed since the U.S. economic melt down but many are still unclear on what happened. Given, it is complicated and the barrage of economic jargon does not help either.

.

Here’s a simple illustration to help you grasp the basics of the crisis.

1. The American Dream

Families want homes. They contact a Mortgage Lender who lends them a Mortgage Loan. Everyone wins! They become homeowners. Mortgage Lender profits from fees and interest payments.

2. The Opportunity

The Investment Banker buys the Mortgages from the Mortgage Lender, who is more than happy to transfer the risk of the mortgage to the Investment Banker. If the homeowner defaults, it is now the problem of the Investment Banker.

The Investment Banker leverage on the low interest rates and borrows millions of dollars to purchase thousands of mortgages.

Each month, the Investment Bank receives payment from homeowners. He repays his debts and makes lots of money.

Interest Rates Lowered

To keep the economy strong after the Dot.com bust and 9/11:

- The US Federal Reserve lowered interest rates to only 0% – 0.25%.

- Investors who traditionally buy Treasure Bonds find the returns too low. They begin looking for other avenues that offer better returns.

- Banks can now borrow money at only 1% to make more money.

3. The packaging of collaterised debt obligation (CDO)

Investors begin to notice the opportunity and want in on the action.

The Investment Banker comes up with an idea to bring together the Mortgages and the Investors.

The Investment Banker packages the Mortgages in a good looking can called CDO, and sells them to the Investors.

Opening up a can of CDO

A CDO is a mix of debts that are rated safe, okay or risky with deferring rate of returns.

- SAFE – 3% Investors

- OK – 5% Bankers

- RISKY – 7% Hedge Funds

4. High demand for CDOs

Everyone makes money. Investors want more CDOs.

But, everyone who qualified for a house already had one because of the easy loans.

So, where do you get more borrowers?

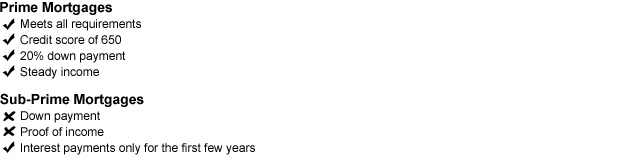

5. From prime to sub-prime

Mortgage Lenders begin to lower the standards to qualify for a loan. As they will sell off the mortgage as soon as they got it, there was no risk to them and they still make money through a one-time fee.

Why sub-prime

When the housing market was booming, it seemed that house prices would never fall. As such, these loans were backed by houses of increasing value. Even if the borrower defaulted, the Investment Banks could put the property up for sale and recoup their money.

6. Sub-prime mortgages become the rage

With its lax standards, Sub-Prime mortgages are snapped up.

They were then quickly turned around and sold off to Investment Bankers who packaged them into CDOs and sold them to Investors and Speculators.

Again, everyone is happy!

7. But then…

Eventually, the Sub-Prime homeowners have to begin paying Interest + PRINCIPAL. Their monthly repayments skyrocket and they start to default.

At first…this was ok

The Investment Bankers foreclose a few houses and still got good value on the houses on a rising market.

8. Then…the unthinkable happened

More and more began to default and there were more houses than buyers on the market. House prices began to tumble.

Why house prices fell

Average household income stayed the same, house prices went up. Even with the easy loans, people simply couldn’t afford the houses anymore.

More supply than demand. More and more houses were still being built and the market had to correct itself.

9. Paranoia begins

Investment Bankers need to sell their CDOs to pay back all the money they borrowed. But Investors know that CDOs are no longer a money making machine. They don’t want it or they already owned thousands of CDOs that were plummeting in value, resulting in huge losses for the companies they invested for.

10. Leading to the credit crisis

Banks could not afford to lend because they had lost so much capital. This meant that other companies that rely on short term lending to run their day to day business were now strapped for cash. These companies start to cut costs with job cuts, project cancellations and spending freeze.

11. Crisis Spreads Globally

Unfortunately, the toxic CDOs have already seeped into the world financial system. Because CDOs are so complex, unregulated, and interconnected no one even know to what extent their own assets are exposed. Investors and Banks are saddled with worthless assets and unable to recoup their losses. The crisis triggers a mad cycle of stock sell offs, bankruptcies, cutbacks, higher unemployment, lower spending and production. The ripple spreads across the global economy and the world reels from the credit crisis.

Source:

“Crisis of Credit Visualised” by Jonathan Jarvis

“Where Did All the Money Go?” by Emilia Klimiuk

July 2009

LIKE THIS ARTICLE?

LIKE THIS ARTICLE?