Is there a bubble

in commodities?

Based on views by Schroders Investment Limited

Commodities have seen a good run over 2010, and indeed, in recent months as well. This has raised concerns among investors, on whether the asset class is seeing a bubble?

First of all, we need to understand that like investments in any asset class, commodity prices are driven over the long-term by the rules of supply and demand. And like many asset classes, the long term is made up of a series of medium-term cycles, in which prices move up and down as supply and demand fall into and out of alignment with each other.

Long term dynamics of demand and supply behind current prices

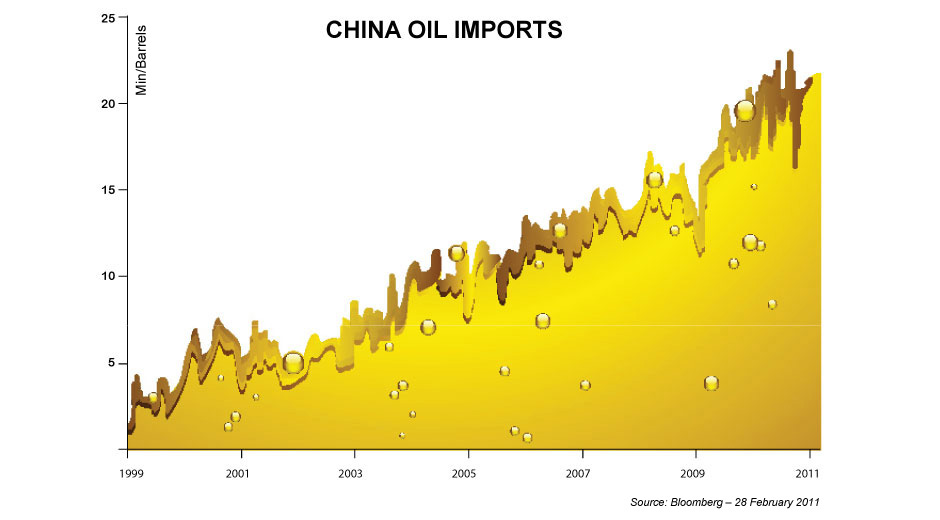

In all three groups, agriculture, energy and metals, the needs of a growing population and a developing world economy show no signs of slowing down. The graph below shows one small facet of this immensely powerful global trend – the growth in Chinese crude oil imports. There are thousands of other examples – some representing long-established markets, others new and emerging ones. In agriculture, for example, it is clear that the surge of interest in the concept of bio-fuels is leading to strong and steady growth in demand for crops like corn (which is used to make ethanol).

The supply of many of the most important commodities is increasingly constrained by a combination of factors. The world’s available area of agricultural land, for example, is now shrinking, partly because of climate change. Some metals and some fossil fuels are becoming much more difficult, and expensive, to extract. Regulations resulting from environmental concerns are slowing the pace of development in other areas.

The outcome of this complex combination of factors is, simply, that providers have not been able to meet the growth in demand. This is an important reason to anticipate rising commodity prices – which in turn spell good news for investors.

Nearer term outlook still positive

Looking ahead to the rest of 2011, we believe that there will be strong returns from the asset class, particularly in the first half of the year. In oil for example, after a range bound year in 2010, we believe that prices will move ahead based on increasing growth in US and Europe and a decline in inventories. This has been accelerated by a risk trade resulting from the events in the Middle East, and we expect these tensions to continue.

For precious metals, increasing political risk, rising inflation and the falling US dollar should ensure that prices move to new highs in 2011. In contrast industrial metals, after strong rallies in 2009 and 2010, are vulnerable to a slowdown in Chinese growth later in the year.

In all, we continue to favour agriculture, and believe that corn, wheat, palm oil, soy beans, cocoa and coffee will all move strongly ahead over the next few months. That said, one key risk to this favourable outlook would be a sharp slowdown in global growth, which would spell bad news for energy and industrial metals prices in particular.

Right asset class, right time

No one asset class price move up continuously, least of all commodities. Although commodities are generally a volatile sector over the shorter term, prices have tended to rise and fall in a broader cycle that lasts between about 20 and 25 years, and we believe that we are now into a rising cycle that began shortly into the new century. Therefore, investors should still be able to gain from the longer term story of the asset class.

Furthermore, commodities tend to be a natural hedge against event risks. We are all familiar with how oil prices rise when there is increased violence in the Middle East, supply disruptions in Africa and extreme weather. It’s not just oil – wheat prices were boosted after significant pressure was exerted on supply owing to poor weather during harvesting. In short, geopolitical crises and extreme weather events tend to depress equity markets but are generally favourable for prices in the commodities sector.

Talk to your Relationship Manager today for more information on starting an investment portfolio that best suits your needs.

This article does not constitute an advertisement, offer, invitation, commitment, advice or recommendation to make a purchase of securities or enter into any such transaction. The information given in this article represents the views of Schroders Investment Limited. HSBC Bank Malaysia Berhad is not involved in the preparation of this article. The Bank neither endorses nor is responsible for the accuracy or reliability of, and under no circumstances will the Bank be liable for any loss or damage caused by reliance on, any opinion, advice or statement made in this article. Investment involves risks. You should refer to the offering documents and/or relevant documents for further details. You must make your own assessment of any such transaction and the risks and benefits associated with it and of all the matters referred to above in view of your investment experience, objectives, financial resources and circumstances. You should enter into transactions only after having considered, with the assistance of your external advisors, the specific risks of any such transaction.

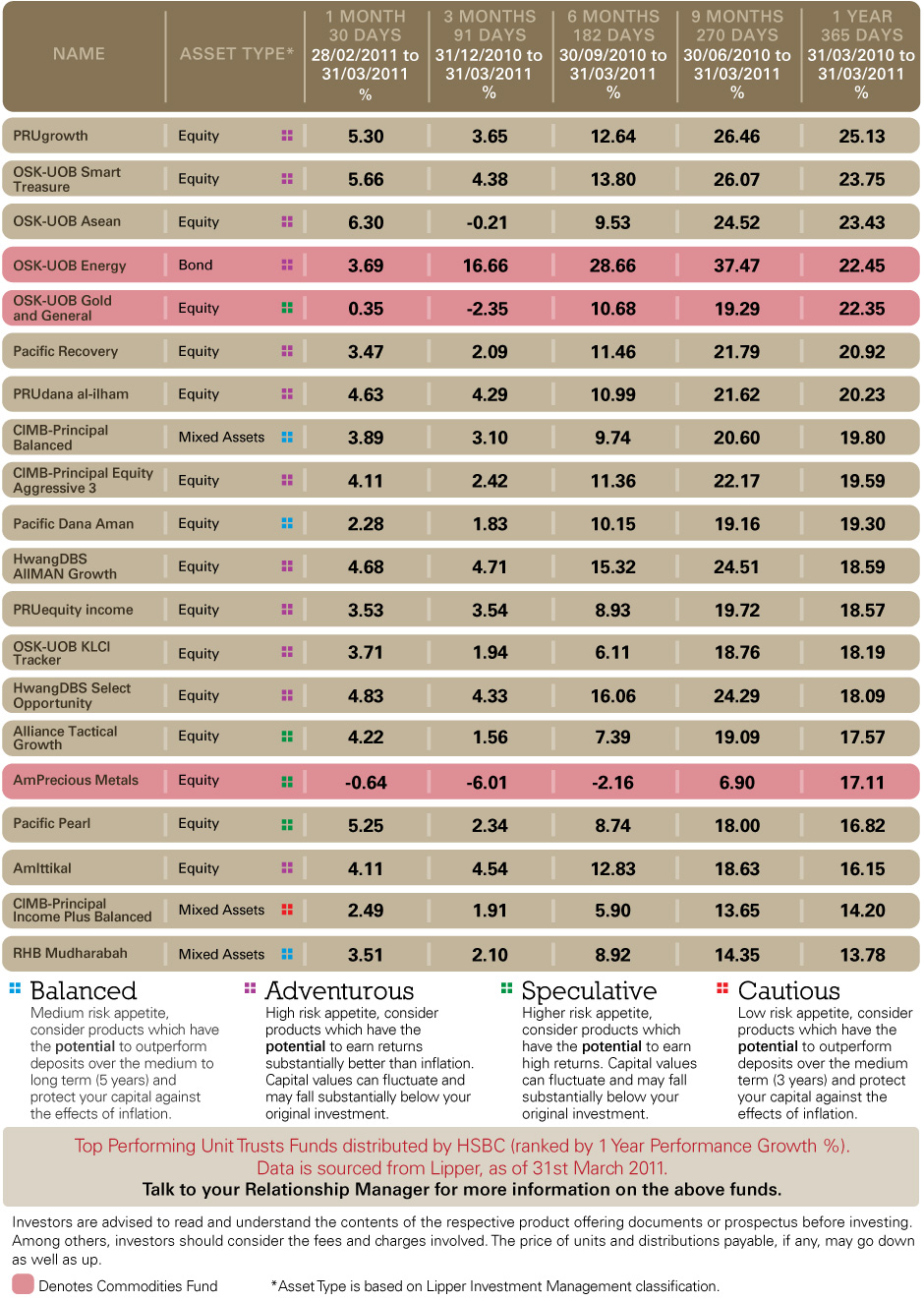

HSBC Fund Selection

Short Term Fund Performance

June 2011

LIKE THIS ARTICLE?

LIKE THIS ARTICLE?