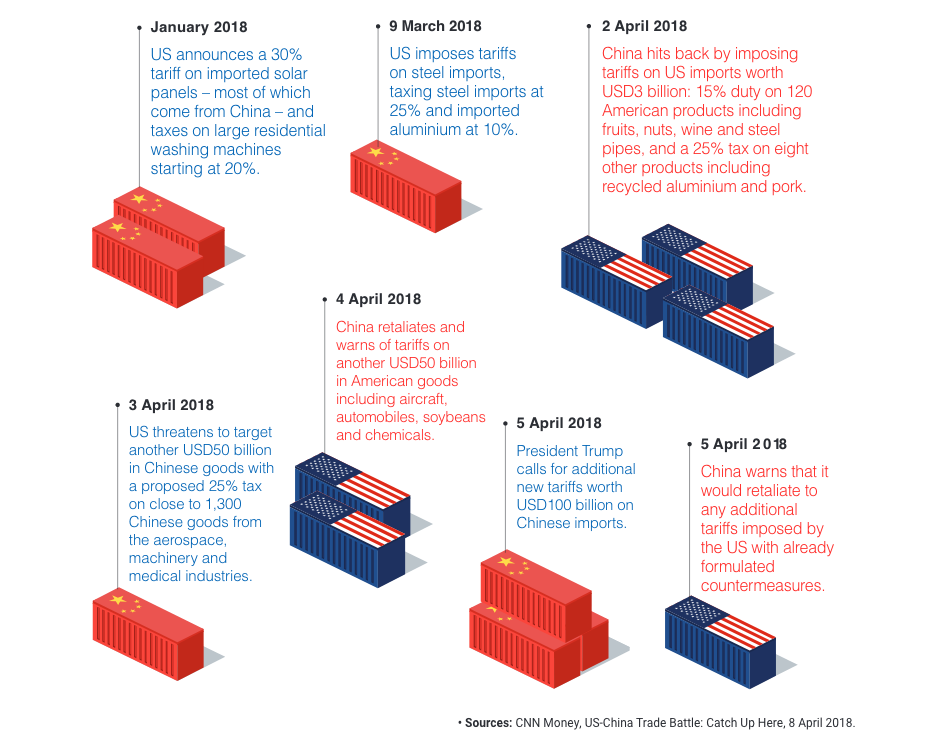

While the US has announced new tariffs on USD50 billion worth of imports from China covering over 1,300 products at a 25% tariff rate, and China has retaliated by announcing its own set of tariffs on USD50 billion worth of US imports at an identical 25% rate on 106 products, neither country has actually implemented the new measures.5

The Chinese government has not specified when the tariffs will be implemented, saying the rollout would depend on when the US introduces its own tariffs. And for the time being, China has signalled their willingness to negotiate.5 On the other side of the Pacific, the US has said it will consult with businesses over a 30-day period before making its final decision.5

It would seem neither side really wants a trade war. A full-fledged trade war between the US and China would have a severe impact on the global economy and there is a risk global growth could fall quickly, according to the director-general of the World Trade Organisation, Roberto Azevedo.6 The hope is that it will not get to that stage. While China has said it is not afraid of a trade war, it maintains that negotiations should remain open.6 The US has also said that it was cautiously hopeful that the two countries could come to an agreement on trade issues.6 HSBC views China’s somewhat tougher than expected response – including suggested tariffs on some commercially-important and politically-sensitive goods such as soybeans – as a strategy of forcing the US to the negotiating table.5 HSBC believes there is a good chance that China may make some concessions in the coming weeks, which may help to calm tensions.5

Potential Economic Impact

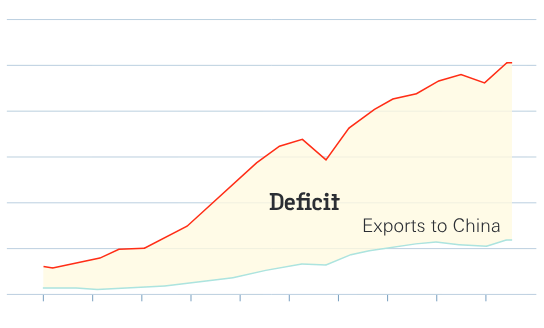

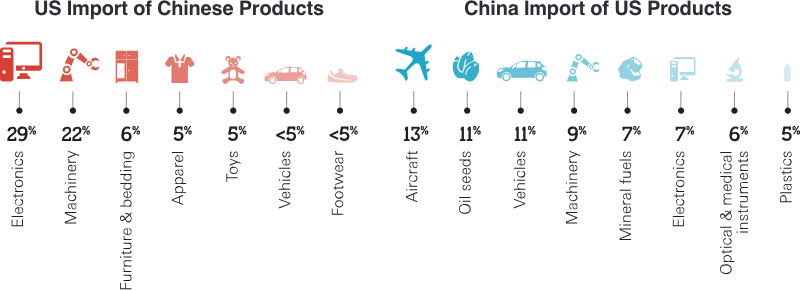

For the time being, assuming the Chinese tariffs are imposed, the impact on the US economy is likely to be minimal.5 The tariffs affect roughly 38% of US exports to China, but it represents only 3% of total US exports in 2017.5 Also, for some products such as aircraft or soybeans, Chinese buyers may accept higher prices given the limited availability of substitutes in the global market.5

For China, the tariffs may push inflation slightly higher, but affected goods only represent a fraction of total Chinese imports, so the overall impact is likely to be muted.5 The Chinese government may also counter adverse economic impacts by some policy support measures.5

However, if a full-blown trade war were to eventuate, the consequences could be dire not just for the US and China, but for other countries as well.7 Countries that sell intermediate goods to China that are used to make products exported to the US like Taiwan and Malaysia could end up on the losing end.7 South Korea, which counts both the US and China among its largest trading partners, could also be a major casualty if a trade war breaks out.7

Overall, Asian economies would likely to be significantly impacted by a full-blown trade war, being export-oriented countries and key suppliers of components to China.7 Big financial centres like Hong Kong and Singapore, which rely greatly on the Chinese manufacturing sector, would also suffer if trade tensions escalate.7

A full-blown trade war would also impact the West.7 Fears of a trade war between the US and China are already driving up borrowing costs and pushing stock prices down.7 Companies with global operations like BMW have also warned that a US-China trade war would ripple around the world.7 BMW said in a statement that barrier-free access to markets is a key factor for growth, welfare and employment throughout the global economy, and a further escalation of the trade conflict between the US and China would be harmful for all stakeholders.7

However, there could be winners as well in this US-China trade war saga.7 Some regions could benefit from a drop in exports of US goods such as soybeans.7 China was the largest buyer of soybeans from the US in 2017, and given that China’s agricultural import needs are generally inelastic, there would likely be a redistribution in trade flow which could see China substitute US soybeans with those from Latin America.7

China’s proposed tariffs on fossil fuel imports from the US could also see the Middle East gaining a greater share of Chinese trade.7 China already sources most of its polyethylene imports from the Middle East and could further increase its reliance on the region if it decides to tax American imports.7 While the US currently accounts for less than 5% of China’s imports of the commonly used plastic, bank analysts expect that number to triple over the next two years if tariffs aren’t imposed.7

Possible Winners and Losers of the Trade War

The Losers

Car Companies

The imposition of tariffs on most passenger vehicles by China would have a significant impact on the American car industry. Major US carmakers General Motors, Ford and Tesla depend on China for 17% of their total revenue. GM has urged both countries to engage in constructive dialogue over trade, while Ford encouraged both governments to work together to resolve issues.

Boeing and Industrials

The Chinese list of goods that will be hit with a 25% tariff includes aircraft up to 45 tonnes in weight, which would affect some older Boeing narrow-body models. While it is not immediately clear how much the tariffs would impact newer Boeing aircraft, the company already saw its shares fall as a result of the tariff announcements along with fellow manufacturing company 3M.

US Farmers and Chemical Makers

Farming equipment maker Deere has seen its shares drop by nearly USD10 as the dispute has escalated, while DowDuPont Inc – one of the world’s largest chemical companies – said its agriculture unit could be affected by the escalating conflict, warning about price declines for soybeans. Grain traders which trade US soybeans in China are also expected to suffer from new tariffs on soybeans.

US Consumers

US consumers are much more reliant on imports than Chinese consumers. Taxing Chinese imports would cause a rise in consumer goods prices and inflation for US consumers.

The Winners

Meat Processors

While the price of soybeans going down is bad news for farmers, US meat processors and exporters have been given a boost. The new tariffs mean that feedstock soybeans will be cheaper, which have driven the share prices of US meat processor Tyson Foods Inc and meat exporter Hormel Foods Corp up.

Chinese Consumers

China has been very careful in picking US products that can be replaced to impose tariffs on to ensure the impact on China’s economy is controllable.

• Sources: ABC News, The Winners and Losers in a US-China Trade War, 6 April 2018.