|

Where once the global economy may have been dominated by developed economies of North America and Western Europe, the global economic landscape of today has changed.

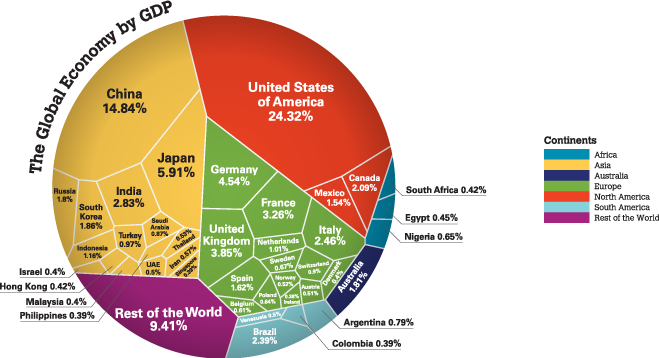

While the United States economy is still the largest in the world at US$18.5 trillion, representing a quarter share of the global economy as of 2016, China and Japan are now second and third with gross domestic product in 2016 of US$11 trillion and US$4.9 trillion respectively representing roughly a 20% share of the global economy.1 When the world’s 40 biggest economies are grouped into continents, Asia has the largest share of the global economy at 33.84% of global GDP compared to North America at 27.95%, while Europe comes third with just over one-fifth of global GDP (21.37%).2

Undoubtedly, Asia has emerged as a powerful driver of the global economy. |

According to the Asian Development Bank in its Asian Development Outlook 2017 report published in April 2017, the region will be the largest single contributor to global growth at 60% on the back of stronger growth in developing Asia supported by higher external demand, rebounding global commodity prices and domestic reforms.

Meanwhile, a new study by Pricewaterhouse Cooper predicts that China will be the world’s largest economy by 2050 with emerging economies continuing to grow faster than advanced countries.2 India will rank second, the US third and Indonesia is expected to grow to become the world’s fourth largest economy.2 |

INVESTING IN A SHIFTING GLOBAL ECONOMY

While you may have a diversified investment portfolio spread locally and in global markets, the shift in the balance of global economy from the traditional Western developed countries to Asia may mean that your view on where to invest may have to shift as well.3

To help you gain a better understanding of how the changing global economy may impact investing abroad, let’s dispel some “myths” associated with investing globally.

Investing Internationally is Too Risky

The global financial crisis in 2008 stung many; it was a case where turmoil and crisis affected markets globally.4 However, over long stretches an internationally diversified portfolio opens you up for less risk of a bad outcome.4 While global markets are somewhat correlated with one another, individual markets tend to move in sync with sectors that dominate their economies.4 Therefore, having broad international exposure helps to diversify your sector bets to reduce risk.4

Even Malaysia’s Employees Provident Fund (EPF) has increased their exposure to global investments to reduce risk.5 In 2015, when Bursa Malaysia was performing poorly, EPF’s global assets, which accounted for a quarter of the fund’s total assets, generated 40% of its total income.5 This income from international investments compensated for the poor performance of EPF’s assets in Malaysia.5

According to EPF, people have a perception or fear that investing abroad is riskier than in Malaysia when in actual fact it’s not.5 EPF says it makes sense to invest internationally because there is more diversification.5

Investing globally also helps to diversify your geopolitical risks.6 Episodes like the Chinese government banning stock sales by major shareholders after the Chinese stock market plunge in 2015, as well as Brexit and Donald Trump winning the US presidential election in 2016, for example, can result in volatility in certain markets.6 As such, diversifying your investments across a range of global markets may help reduce your risk.6

Developed Markets Will Always Perform Better

While the US has long been the world’s largest economy and has set the tone for global markets together with Western Europe historically, it doesn’t necessarily mean that is the case today. While US stocks may have provided higher returns than global equities in aggregate over the past several years, the best performing stock market in each of the past 30 years have been outside the US.7

Historically, the performance of international and US stocks are cyclical; one typically outperforms the other for several years

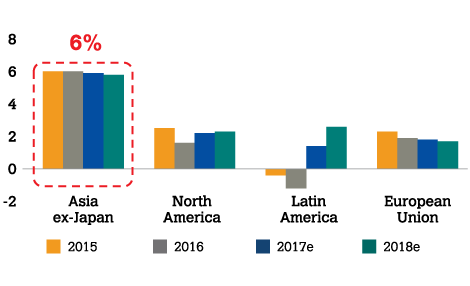

before the cycle rotates.7 While recent performance has favoured US stocks, the cyclical pattern of performance means international markets will take the lead again.7 With projections from the International Monetary Fund forecasting US GDP growth at 2.3% and 2.5% in 2017 and 2018 respectively and Europe at 1.7% in 2017 and 1.6% in 2018, Asia is expected to grow at 6.4% led by China and India8; therefore emerging and developing Asia may potentially offer better odds for investors.

Investing in Multinationals Provides Adequate International Diversification

Some investors believe that they can gain sufficient foreign exposure indirectly by investing in multinationals.4 For example, a third of aggregate revenues for the S&P 500 index of US companies are derived abroad.4 But investing solely in the S&P 500 would mean you would lose out on the opportunity to generate higher returns from a broader array of companies located all over the world.4 As of June 2017, US equities were up about 8%. But better returns could have been found elsewhere with India stocks up 19% and China stocks up 23%.4

In addition, stocks of multinationals with international exposure can sometimes be highly correlated to the performance of the overall domestic equities market.7 Highly correlated stocks in a portfolio may indicate a lack of diversification.7 Therefore, multinationals like those on the S&P 500 are not always good replacements for international equities for diversification purposes.7

LOOKING TO ASIA

With the global economy undergoing a major transformation and the world seeing an accelerating shift in wealth from West to East, the inclusion of Asia as part of your global investment portfolio may be a wise long-term decision.

If you think Asia may not be a good bet, let us dispel some of the myths.

Investing in Asia is Riskier than Developed Markets

The three main areas of concern when it comes to investing and risk are: political, demographic and financial risks posed by excessive debt.9

Political risks come in many forms. Changes in government that result in polarisation because of representative parties can be devastating for economies.9 In Asia, politics have not been a destabilising force with the exception of Thailand, as well as India, where the government has made sweeping reforms for the better.9 Compare this to the state of the US and UK administrations, it is fair to say that Asia’s political environment presents no higher risk than the developed markets.9

Structural long-term challenges brought about by demographic change is another area of risk investors should consider.9 In the developed world, the long-term risk of declining population growth and ageing societies is real.9 In contrast, Asia’s

population on average remains young and growing, providing Asia with a vibrant and growing middle class with greater resources to propel domestic consumption.9

The OECD forecasts that by 2030, Asia will represent 66% of the global middle class population and 59% of middle class consumption.9

Another key risk for Asia has been debt but the good news is Asia’s debt levels are now manageable.9 Foreign short-term loans represent low levels in absolute terms and also relative to non-Asian emerging markets.9

China’s Run has Ended

Proclamations of China’s economic demise as a result of slower growth, the rise in total debt and potential credit issues from the decline in “old economy” industries like coal and steel ignores the booming contribution that the service sector and consumption are making towards GDP growth.9 Even under conservative forecasts, China’s growth is still expected to create an economy the size of South Korea, Canada or Spain every two to three years.11

In fact, China has major structural growth drivers across a range of sectors including travel, technology, consumption, wealth protection and health care.9 The services sector is growing fast as well.9 Labour moving from low-end manufacturing into service is also a healthy transition.9

Returns on Chinese equity are also rising from a combination of significant growth in high return sectors such as technology and consumption, margin increases thanks to benign commodity prices, and structural demand growth from a growing middle class.9

Asia is Just an Emerging Market

Not quite. While Asia may often be grouped together with other emerging markets like Russia, South Africa, Brazil, Turkey and Eastern Europe, it is a far more different market with a combination of emerging and developed economies that is generally less volatile than emerging market assets.10

Asia is also a region characterised by current account surpluses as well as having some of the most efficient and skilled workforces in the world.9

In essence Asia encompasses 48 countries with diverse characteristics, which means markets tend to perform differently.10 In a market comprised of matured economies like Japan, South Korea, Taiwan and Singapore to emerging giants driving global growth in the form of China and India to the ASEAN region expected to grow at 5% in 2017 and 2018, the offsetting nature of their performances means that returns from the region as a whole is generally more steady.10

COMPLEMENTING YOUR

GLOBAL PORTFOLIO WITH ASIA

|

With global economic activity picking up and Asia continuing to deliver a higher GDP growth when compared with other regions in the world, there is value in considering diversifying your global portfolio to include Asian investments.10

As a tool for diversification, Asia complements a global portfolio well. As a region, Asia is heterogeneous in nature, and thus has inherent diversification within the region itself.10 Asia also exhibits imperfect correlation with the rest of the world and can therefore provide diversification benefits to a global portfolio.10 |

By investing in Asia, you invest in a basket of currencies and countries with different economic factors and business dynamics.10 The diversity and differences in the individual markets results in performances that are offsetting in nature, which can offer less volatility, more steady returns and potentially serve as a better diversifier.10 |

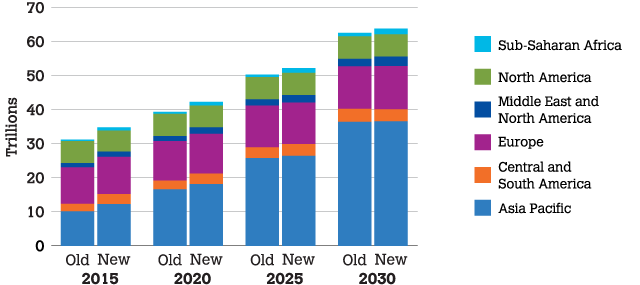

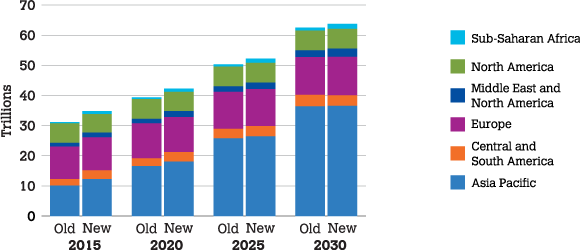

Middle Class Consumption Expenditures

(PPP, constant 2011 trillion $)

Source: Brookings Institution, The Unprecedented Expansion of the Global Middle Class: An Update, February 2017.

Asia’s Upsides

Asia’s position as the driver of global economy is a result of several key factors. The region’s economic development has given rise to a sizeable middle class population, which in turn is contributing to growth in “new economy” sectors such as consumption, healthcare and technology.10 It is expected that this growing middle class in Asia will drive increasing levels of consumption in the years ahead.12 According to some estimates, emerging Asia’s middle class spending will far surplus that of North America, Europe and the rest of the world at over US$30 trillion by 2030.12

Increased fiscal stimulus and spending on infrastructure in Asia will bolster growth in the region.10 Reform agendas including China’s rebalancing of the economy which should lead to sustainable growth, India’s structural reforms to help long-term

growth prospects, Indonesia’s expansion in capital spending to sustain economic growth, and Korea’s corporate governance reforms to pave the way for better shareholder returns will also drive growth.10 Forecasts expect Asia to enjoy higher GDP growth in the 6% region through 2018 compared to the rest of the world.10

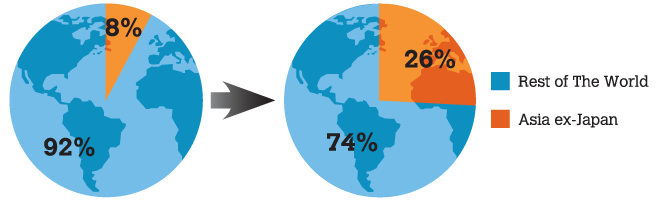

Even though Asia is driving global growth, the region is underrepresented in equity benchmarks.13 This is apparent from the discrepancy between the region’s lower weight in the MSCI AC World Index compared to its larger share of world market capitalisation.13 With representation of Asian equities in major global indices likely to rise as markets like China continue to open their doors to investment,10 interest from international investors should rise implying potential appreciation ahead.13

|

High GDP Growth in Asia Compared to The Rest of The World

|

Size of Global Middle Class (Billion People)

|

|

|

|

Source: Bloomberg, data as of May 2017.

|

Source: Brookings, “Old” refers to estimates from 2010; “New” refers to latest estimates, updated as of 2017. |

|

MSCI Classification vs Actual Market Capitalisation

|

|

Source: Bloomberg, FactSet, Mirae Asset Global Investments, March 2015.

Whether you are looking for growth, income or yields, Asia offers a basket of options that can fit your investment needs.

Asian Equities for Growth and Income

|

|

Asian Bonds for Yields

|

|

The RMB Factor

Naturally, no discussion of a global portfolio is complete without factoring the RMB. Over the long-term there will be greater use of the RMB in both trade and financial transactions globally, as well as an increase in global asset diversification into RMB assets.10 China’s opening up of its capital markets will also accelerate the importance of the RMB.10

With global indices moving fast to include onshore Chinese bonds – China has the world’s third largest bond market – into new global bond indices, there is an entry opportunity for investors to take advantage of current attractive valuations ahead of potential increased investor demand.10

If you are interested in including global and Asian investments into your portfolio or would like to rebalance your current global versus Asian assets, we are here to help. HSBC offers a variety of investments such as Unit Trust, Structured Investment, Retail Bond and Dual Currency Investment to meet your investment needs. These investment vehicles provide investment exposure ranging from Global to Asia and Malaysia. As part of HSBC’s efforts to continuously emphasize on the importance of portfolio diversification, the bank introduced different reference asset-mix models (Portfolio Allocation Services) to assist customers with differing risk profiles to build optimal unit trust investment portfolios in meeting their financial goals.

Speak to your Relationship Manager or walk into

any HSBC branch to find out more.

• Sources: 1 World Bank, World Development Indicators Database, April 17, 2017. 2 World Economic Forum, The World’s 10 Biggest Economies in 2017, March 9, 2017.

3 Nerd Wallet, What a Shift in the Global Economy Means for Investors, September 6, 2016. 4 Time.com, 3 Good Reasons You Should be Investing Overseas Now, June 20, 2017. 5 New Straits Times, Tough Year but Reasonable Return on Assets Expected, November 19, 2015. 6 The Fifth Person, 5 Reasons Why You Should Invest in Foreign Stock Markets, January 16, 2017. 7 The Atlantic, Five Myths of International Investing, undated. 8 International Monetary Fund, World Economic Outlook, April 2017. 9 City Wire, Why We’re Only at Start of Powerful Asian Bull Market, August 17, 2017. 10 HSBC Global Asset Management, Allocating to Asia, June 2017. 11 Institutional Investor, 5 Myths to Ignore About Emerging-Markets Equities, 26 February 2016. 12 Mirae Asset Global Investments, Why Invest in Asia, undated. 13 Mirae Asset Global Investments, Are You Invested in Asia?, undated.