IMPACT INVESTING

Creating Positive Change Through Investments

Every now and then we hear about the widening social economic gap and the challenges faced by the social underclass such as poverty, unemployment, homelessness and crime. We also hear about how our continued pursuit of economic growth can sometimes come at the cost of our environment.

Does the pursuit of economic and financial gain have to come at the expense of our society and the environment?

With impact investing, perhaps not.

Impact investing is a growing field of investment helping to finance solutions to society's most pressing challenges. It is defined as investments that set out to achieve positive social and environmental impact as well as a financial return, and the ability to measure the success of both.1

While the impact investing market is still in its infancy, funds that promise to put money to work for the good of society are growing rapidly as investors look for alternatives to traditional assets.2

According to Liquidnet Holdings, a global institutional trading network, the impact investing market is worth USD50 billion currently, and growing.3 Studies conducted by J.P. Morgan & Global Impact Investing Network (GIIN) from 2011 through 2014 found that investors are increasingly satisfied with impact investing and plan to invest more money in the future.3

How Impact Investing Benefits People and Communities1

-

Governments

better outcomes and greater flexibility to target spending and encourage more private capital into areas where there is a need for new solutions -

Philanthropists

with options to generate more impact through their activities -

Investors

greater choice and new opportunities to put their money to use in ways that make a financial return and also benefit society -

Communities

when they can fund new opportunities to develop services and infrastructure, as well as generate jobs -

Mainstream financial markets

from access to finance for initiatives and services that create positive impact in the community -

Institutional investors

more options for diversifying their portfolios and fulfilling their duties as fiduciaries -

Socially motivated entrepreneurs and organisations

access to finance and support, helping them grow their businesses and have greater impact

The Benefits of Impact Investing

Impact investing proves that it is possible to "make money" while at the same time "making a positive impact", dispelling the notion that investing for profit and giving money to charities must be separate activities.1

Impact investing is the perfect fit for those of us who want to be remembered as agents of change who tried to leave a legacy of positive social impact. Planning for our financial future in this way means that the assets that we have accumulated over a lifetime can contribute to the greater good for many more lifetimes to come.

Where to Invest to Make an Impact

Beyond the traditional risk versus return consideration of mainstream investments, deciding where to make our impact investment is also about identifying which specific social issues we are passionate about.

Impact investing is not just about niche markets. There are opportunities across varied sectors that together make up significant percentages of any country's GDP.4

Impact sectors aren't limited to what sometimes are labelled as "progressive" causes (like fairtrade) but include more traditional sectors as well. Some areas such as community development are well established, with many players and billions of dollars of capital committed annually. Other opportunities are still emerging and have newer financial instruments and arrangements.4

Finding impact investments can take more time and work, but if we are committed to making a difference then the extra effort can be worth it. Also, because some impact businesses are establishing markets or pushing the envelope with their business plans, they may have a longer time to liquidity - so patience is key.3

As with any investment, investors need to do appropriate due diligence around the business model and leadership team to ensure the plan can be executed before making an impact investment. With impact investing, we need our heart as well as our head.3

Potential impact investing sectors4

-

Microfinance and financial inclusion

-

Community development

-

Sustainable consumer products and fair trade

-

Renewable energy and climate change

-

Natural resources and conservation

-

Small business finance

-

Health and wellness

-

Education

-

Sustainable agriculture and development

Risks vs. Returns: Impact Investing Strategies

The basic principle of investing requires investors to balance risks versus potential returns. Impact investing adds a third variable of social impact, requiring investors to balance three dimensions in their investment strategy, which can prove challenging. By looking at how other investors have struck a balance, certain profiles and strategies for impact investing emerge.

Blended Strategies4

Some investors are willing to take lower financial returns, or perhaps higher risks for an expected return, in order to have an impact. This is considered the "blended" social and financial return.

Market Rate, with Impact4

These investors look at impact investments like any other, with the expectation of market rate return, but then filter for social impact as well.

Sector-Focused4

Sector-based investing can be very impactful in "priming the pump" for market-based solutions. Early investments in a targeted sector may yield dramatic innovations that provide benefits to the sector as a whole, rather than the return accruing to one specific company. Early investments in sector innovators may ultimately yield market rate opportunities.

Impact alpha4

A growing number of investors are making the case that "impact" may represent a fundamental insight that the rest of the market doesn't yet fully value, raising the possibility of better than market rate returns. These investors reject the trade-off between social impact and financial return - rather than seeing returns or impact they see returns from impact. They target investments with sustainable business models with intrinsic focus on a product or service that delivers social impact. If the businesses succeed they can deliver financial and social returns at scale.

Measuring the Social Returns

Measuring the returns on a traditional investment is simple: we all know how to measure the bottom line. But how do we measure the social or environmental impact of an investment? After all, it is the distinguishing feature of impact investing.

While there is no set global standard yet, there are a number of measurement tools and frameworks emerging globally including IRIS metrics, B Analytics and new impact measurement initiatives being developed in the UK and Europe, which are beginning to set standards for how to measure the social and environmental performance of organisations and their programmes. The Social Impact Investing Taskforce established under the UK's presidency of the G8 has also set out best practice guidelines for measuring impact.1

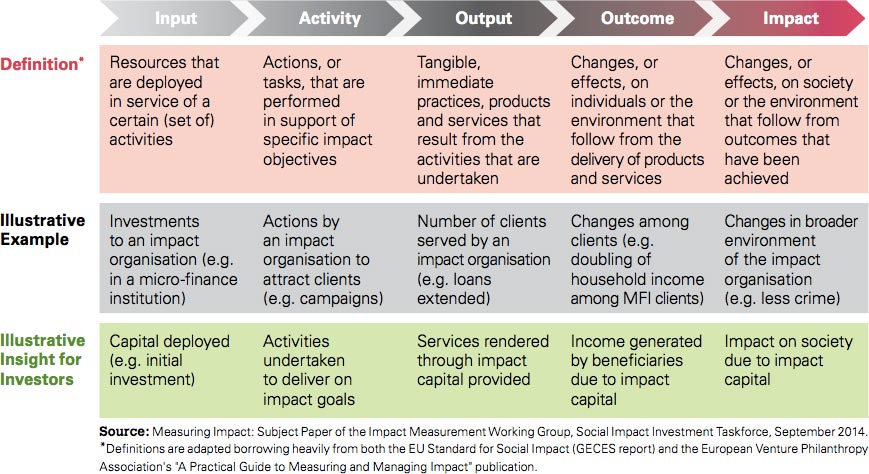

Impact measurement is important because it shows the value a programme is delivering to its beneficiaries and society as a whole, and helps ensure transparency and accountability. It enables stakeholders - from government, investors, management to employees - to understand the effectiveness of a programme in terms of its outcomes, and beyond its outputs. More importantly, it can be used to help improve the social impact a programme generates.1

Impact Value Chain: A Progression Of Measuring Meaningful Change

A Rosy Future for Investors and Society

According to a research that covered both public and private investors by J.P. Morgan and Global Impact Investing Network (GIIN) released in early 2013, organisations investing at significant dollar levels in impact investing were "satisfied" with their financial returns - an important statement on the impact investing sector's ability to deliver results at scale.4

The research tracked the progress of close to 100 investors who cumulatively managed over $35 billion of impact investments, two-thirds of whom were pursuing market rate returns. Of those surveyed in the research, 68 percent said their investments were "meeting their expectations" for both social and financial returns, while another 21 percent said their investments were "outperforming." A significant number of investors reported they had at least one "home run" - an investment that significantly outperformed expectations while delivering the intended impact.4 Impact investing looks poised to help address many of society's toughest problems as well as the sustainability of our environment. We could potentially drive this revolution through impact investing to power entrepreneurship, innovation and capital for public good.

1 Impact Investing Australia, undated.

2 CNN.com, Can You Make Money and Feel Good About It?, October 24, 2013.

3 Forbes.com, Impact Investing: How To Get A Return While Doing Good, April 22, 2015.

4 The Case Foundation, A Short Guide to Impact Investing, September 2014.

LIKE THIS ARTICLE?

LIKE THIS ARTICLE?