Retirement Realities:

When myths and facts collides

If statistics are right, by 2020, 3.4 million Malaysians (9.9% of Malaysia’s population) will be over 60 years of age.1 That means almost one in 10 persons will likely be in retirement age.

If you are the one in 10 heading towards retirement in the next few years, now may be a good time for a retirement reality check. Or even if it is a little further off for you, you may wish to glean the wisdom from those who have made the transition from active work to a retired life.

The latest report in a series of independent global research studies commission by HSBC, “The Future of Retirement: Life After Work”, (FoR) compares the real-life experience of today’s retirees with the views and expectations of those still working towards retirement.

The report yields a number of interesting finds, namely the disparity between a desired retirement (of those still working) and reality (as reported by retirees). Let’s take a look at some of these findings and learn from these insights which may help us move towards the retirement we desire.

The FoR report is the ninth in the series and is based on a survey of more than 16,000 people in 15 countries conducted between July 2012 and April 2013.

Retire at 55 – many Malaysians want to but may not get to.

Malaysians are an optimistic lot. Despite rising inflation and the revision of the public and private sector retirement age to 602, a good many still aspire to retire on average at age 55. From the countries surveyed, Malaysians ranked third lowest after Brazil (46) and China (52), compared to the global average of 59 years.

Working age Malaysians may desire to retire at 55, but it may be unrealistic given increasing life expectancy and the need to fund a longer period living in retirement.

Life expectancy in Malaysia has grown, with the average male living until age 72 and female to age 773. That could mean another 17 years living in retirement, should a man retire at age 55. These factors necessitate working longer beyond current retirement age.

Retirement aspirations and dreams differed

Working age people may have certain notions of how they want to live their retirement years. Travelling extensively, golfing whenever they want to, spending time with friends and family – these are just some common aspirations mentioned in The Future of Retirement: Life After Work (FoR) report. Besides that, some expect to have more free time and have no dependents to look after. However, the reality of retirement does not always live up to peoples’ aspirations.

For many, these aspirations remain just dreams as they failed to save adequately for themselves from an early age. When asked why they have not been able to realise all their later life hopes and aspirations, retirees most often cite having less money

to live on than they envisaged (49%), a third (33%) are still caring for dependents while almost a third (32% respectively) blame health reasons and having less time than they thought.

Given that a lack of adequate preparation can be an obstacle to realising retirement aspirations, the Future of Retirement survey asked retirees to look back at the best financial advice they have ever received. ‘Start saving at an early age’ was the most popular piece of advice (chosen by 63%), followed by ‘Buy only what you need’ (52%) and ‘Develop a financial plan for the future (52%).

Retirement vs leaving a financial legacy

Many retirees plan or aspire to leave a financial legacy to their children or other relatives, which often takes the form of a financial gift or inheritance. This assistance from parents and older relatives can be very helpful to younger people in achieving important goals such as higher education or home ownership.

The ability to provide a significant financial legacy is hampered by economic factors, such as the need for parents to help their children own a home. Given the current

Malaysian property prices, fresh graduates or young working adults may not be able to afford to buy their own home. Landed property in Petaling Jaya, Selangor may go for RM1 million and for a modest 2-bedroom apartment, one may have to fork out RM300,000 upwards4. Consequently, parents may need to step in to help fund their children’s home purchase, often dipping into their retirement funds or EPF savings, which may lead to insufficient funds to see them through old age5.

Besides giving cash gifts, the FoR research also found that another form of financial legacy in retirement is funding a dependent. With improved health, longer life expectancy, low mortality as well as declining fertility, retirees may

be faced with the dual challenge of looking after their children as well as aging parents. These caring responsibilities of retirees are expected to grow, not diminish, as more people live longer into old age.

Retirement ins and outs

One of the chief concerns of retirees is the over-estimation of retirement income and under-estimation of spending during retirement. While many expect retirement expenditure to be reduced, the fact is spending has not fallen in tandem with income. Faced with retirement income shortfalls and unrealised aspirations, many retirees (85%) carry a sense of regret about their failure to prepare adequately for a comfortable retirement.

Unlike a working person with a steady monthly income, retirees may not have the luxury of a secure stream of income. From the FoR research, the sources of retirement income is mainly derived from cash savings (21%), with personal retirement plans (16%) and the Employees Provident Fund (EPF) (14%) also making significant contributions.

Working age people expect a similarly large proportion of retirement income to come from cash (23%), though they think a larger amount of their income will come from investments (16%). Male and female retirees have similar retirement income sources, although women are more reliant on cash savings. Of those earning less in retirement than expected, the most commonly cited reason is outstanding debt (62%), followed by unexpected events (44%) and insufficient planning (30%). Many also did not factor in healthcare costs and medical inflation, which is expected to be 15% per annum, in their retirement planning6.

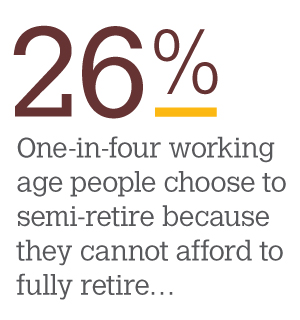

The rise of semi-retirement

After many years of working, days of lazing by the pool and playing golf may seem like a retirement dream come true. However, for 54% of Malaysians retirees, that’s not the complete picture. For them, work life does not need to end abruptly at age 60.

What they have found is a sweet spot called semi-retirement in which retirees scale back their work life and amp up leisure hours. They may choose to do part-time work, consulting or even start their own business. By reducing their work hours, they free up more leisure hours to pursue their other retirement aspirations like travel and spending time with grandchildren.

According to HSBC’s “Future of Retirement: Life at Work” (FoR) report, “Semi-retirement involves a reduction in working hours but a continuation of some paid employment as one approaches or reaches retirement age. Over half of those not fully retired either plan to semi-retire (54%) or are already semi-retired (5%). Moreover, a third (33%) of 55-64 year olds are already semi-retired.”

There are various reasons why semi- retirement is a growing trend. The FoR reports show that many expect to semi-retire for positive rather than negative reasons. As the chart shows, 47% see semi-retirement as a way of ensuring that they keep active or keep their brain alert.

A further 35% see it as a way of ensuring an easy transition into retirement, while 37% enjoy working and want to continue in some capacity. The report adds, “The overall picture emerging is that today’s workers equate semi-retirement with the notion of early retirement.”

Besides the social benefits and mental stimulation of an extended work life, semi-retirement is helpful for those unprepared financially for full-retirement. One-in-four (26%) working age people choose to semi-retire because they cannot afford to fully retire, and 24% see it as a means of bridging a shortfall in retirement income.

Through semi-retirement, retirees may still enjoy earning an income and delay dipping into their nest egg, which may allow more time for investments to grow.

Semi-retirement also gives retirees flexibility to ease into the next phase of life by testing waters to see what suits them best – whether to work part-time, go back to full employment or retire fully. Work, even part-time, may help keep skills sharp and keep the door open for the return to full-time employment, should they decide to make a career comeback7. On the other hand, retirees may realise after a period of semi- retirement that they prefer not to work and move on to full-time leisure.

Semi-retirement – your best bet?

While semi-retirement may seem like a happy marriage of work and leisure, it is best seen as a possible option for the future, rather than a certainty. Not everyone may choose to semi-retire. From the FoR survey, only one in two employees (57%) were given the option to semi retire. Some employees may see the value of retaining older workers who bring with them years

of experience and maturity but some employees may deem older employees are expensive and outdated.

Just because employees are interested in semi-retirement does not mean work will be readily available.8

Then, there is the issue of poor health. With age, a retiree’s strength and mental acuity may deteriorate, which may be obstacles in holding down a job9.

Semi-retirement is not a retirement replacement plan

To count on working past retirement age to fund your retirement is a substantial risk. There are no guarantees that you will certainly find employment or that your health will permit. Starting your own business may also present its own set of opportunities and risks, which may add to or deplete your retirement funds.

While semi-retirement may be an option it does not replace a retirement plan. Consider saving now for your retirement so that you may have the option to retire – fully or otherwise – when the time comes. When you are financially secure, you can then choose to scale back your work week to three days or not work at all. Semi- retirement is not an excuse to not plan for retirement. In fact, good retirement planning may reduce your future financial worries and let you enjoy working, should you choose to do so, even in later life.10

Retirement lies we tell ourselves

Saving for retirement may prove to be one of our biggest financial challenges in life. Simply because the sum that we have to save for retirement is huge – an amount that should be large enough to keep us financially afloat for at least 20 years, if not more. It is also a long term pursuit with a distant finish line compared to saving for, say, a downpayment for a house, which you may be able to accomplish within a few years.

What is more, in terms of our priorities, saving for retirement may lose out to other more pressing matters or more enjoyable pursuits. And to make matters worse, we may talk ourselves out of it with unfounded rationalisations, so that we can avoid the difficult task of saving for retirement11. Those are the subtle lies we tell ourselves about retirement. Not any more! Here is a list of the common retirement lies and how we can bust them.

Now that we’ve busted these lies, may the truth of retirement planning set you free to start saving for your future.

Making your own retirement aspirations a reality

Based on the FoR findings which examined the experiences of today’s retirees and compared them with the expectations of working age people currently saving for retirement, four main important insights and practical actions emerge which may help working age people prepare more effectively for their own retirement.

……….ACTION 1…………….

Don’t rush into retirement

While not having to work may seem like bliss to a working person, don’t be too hasty in giving up paid employment. Nearly two-thirds (64%) who entered semi-retirement wished that they had stayed in full time employment longer for monetary as well as social benefits. Work is often seen by retirees as an important means to keep mind and body active. Staying in employment longer may boost retirement savings and also shorten the duration of dependency on retirement funds.

……….ACTION 2…………….

Don’t rely on one source of retirement income

Multiple income streams is key in retirement, in order to spread the sources of retirement income and associated risks. That means not all their eggs are in one basket. On average, current retirees have three different sources of retirement income, wisely choosing not to generate all of their income from one place. Besides the EPF, look at alternative avenues for retirement savings which are suited to your risk profile, such as HSBC’s Takaful Retirement Plan, private retirement schemes, diversified investments in property, stocks, bonds and unit trusts amongst others.

……….ACTION 3…………….

Plan your retirement with family in mind

The idea of retirement being just about you and your spouse (or your golf set) may no longer hold true. Rather, family will continue to be a major consideration in retirement planning, and may even grow in importance for the next generation. While many people (40%) aspire to travel extensively during their retirement, nearly half (49%) of current workers expect to have some financial responsibilities towards others even when they are themselves retired. This includes ongoing financial responsibilities for their adult children as well as supporting frail elderly parents.

Do what you can to prepare for this eventuality as early as you can. If you have young children, you may consider taking up an education plan to pay for their college years later on. Or you may consider investing in property so that you may give them a home in the future. If you have parents getting along in years, you may want to shop around for a personal accident and/or medical plan that may provide some coverage should their health deteriorate. A plan today can help cushion against rising costs in the future.

……….ACTION 4…………….

Be realistic about your retirement outgoings

Don’t assume that your expenses will go down once you enter retirement. 52% of people in retirement have seen no reduction in their outgoings, and 17% have seen their outgoings increase. You may also want to take into account your own longevity and the consequent increase in later life medical and nursing care costs, which you may need to prepare for. Consider taking up an insurance plan that provides increasing coverage, such as HSBC’s HealthPlus which provides an increasing annual medical coverage of 5% at the end of every policy year up to 2X the initial medical coverage. It is also guaranteed coverage up to the age of 81.*

*The plan expires when the Life Assured attains 81-years-old (age nearest birthday. TPD coverage will expire upon the Policy Anniversary when the Life Assured attains 65-years-old (age nearest birthday).

If you need more assistance in planning for your retirement, please talk to your Relationship Manager or visit any of our branches for more ideas and insights.

Source: 1 The Edge, “Models of Senior Living for Malaysia” June 21, 2013. 2 Ministry of Human Resources, “How Minimum Retirement Age Act Affects Working People”, September 02, 2012. 3 2012 estimates from Department of Statistic Malaysia. 4 The Edge, “Make Speculators Pay for Rising Property Prices”, August 5, 2013. 5 Malaysia Chronicle, “Young professionals in Malaysia struggle to own property” 14 July 2013. 6 The Borneo Post, “Medical protection part of holistic wellness plan”, March 25, 2013. 7 SeekingAlpha, “New ways to think about retirement: semi-retirement”, March 2, 2011. 8 US News, “The Rise of Semi- Retirement”, September 30, 2013. 9 Forbes, “U.S. Retirement Poll: The Big Lie And The Big Fantasy,” March 22, 2013. 10 SeekingAlpha, “New ways to think about retirement: semi-retirement”, March 2, 2011. 11 LearnVest.com, “The 11 Biggest Retirement Lies We Tell Ourselves” November 14, 2012. 12 US News, “Lies We Tell Ourselves About Retirement”, January 23, 2013. 13 CNBC, “Seven Lies People Tell Themselves About Retirement”, December 6, 2012. 14 BusinessInsider.com, “13 Money Lies You Should Stop Telling Yourself By Age 40” April 25, 2013. 15 Lembaga Kumpulan Wang Simpanan Pekerja, “Laporan Tahunan Annual Report 2012”. 16 The Star, “Malaysians don’t save enough to see them through their retirement years”, August 10, 2013.

All research here refers to “The Future of Retirement: Life After Work. 2013” Global Report and Malaysia Report, unless otherwise stated. Reproduced with permission from The Future of Retirement, published in 2013 by HSBC Insurance Holdings Limited, London. The “Future of Retirement: Life at work” Global and Malaysia report is available online at www.hsbc.comretirement.html

LIKE THIS ARTICLE?

LIKE THIS ARTICLE?