…a better solution is to maintain a long-term view of your investment…

A Bumpy 2018

Strong and synchronised global growth in 2017 offered hope for more of the same in 2018. 3Alas, 2017 has given way to a weaker and more varied picture in 2018 and as we head into next year.3

Economic growth may have remained robust in the United States in 2018, but signs of deteriorating momentum have emerged in much of the rest of the world since the start of the year. 3 Cyclical indicators point to slower and more uneven growth in the global economy for the rest of 2018 and into 2019.3

The biggest economic story of 2018 has probably been the escalating global trade tensions – particularly between the United States and China – which has kept financial markets on edge.4 The IMF has warned that global economies are going to suffer from the US-China trade clash, saying in a statement in October 2018 that while global growth currently remained “steady”, the risks are “increasingly skewed to the downside amid heightened trade tensions and on-going geopolitical concerns.”5

The west’s leading economic think-tank, the Organisation for Economic Cooperation and Development (OECD) has also expressed its concern about the effects of the protectionists measures imposed since the start of 2018.6 “Global trade growth slowed in the first half of 2018, with trade tensions already having adverse effects on confidence and investment plans,” said OECD.6 It added that increased trade tensions and uncertainty about trade policies were a “significant source of downside risk to global investment, jobs and living standards.”6

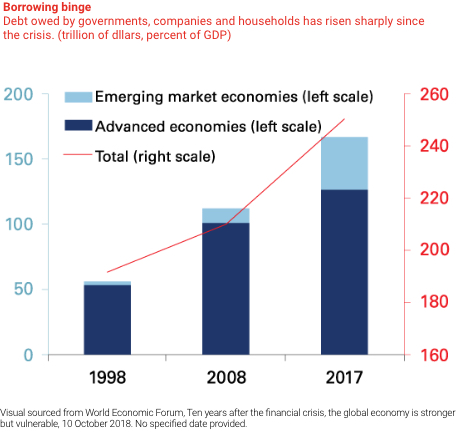

Beyond escalating trade tensions, the US has also had a role to play in the increasing pressures on emerging market economies in 2018.1 The stronger US Dollar and higher US interest rates have made overseas borrowing more expensive for emerging markets, especially those with larger credit needs and weaker economic conditions or policy frameworks.1

Growth has proven to be less balanced than hoped in 2018. 2 Not only have some downside risks that the IMF’s last World Economic Outlook report been realised, the likelihood of further negative shocks to the organisation’s growth forecast has risen.2

Headwinds in 2019

As we look ahead to 2019, several key factors will likely influence how the global economy performs.

The US-China trade standoff looks set to continue. Tensions have soared recently with US President Donald Trump’s administration rolling out billions of dollars in new tariffs against China.5 And the US’s hard line approach seems likely to remain with US Treasury Secretary Steven Mnuchin downplaying global concerns expressed by the IMF5

Pushing back against growing global unease over the US-China trade fight, Mnuchin said pressuring Beijing into adopting more open trade policies would be good for all.5 However this sentiment is not necessarily shared by others who worry that the trade conflict will be bad for all economies including the US, China, Asia and the rest of the world.5

In addition, if growth in the US continues at a robust pace buoyed by a pro-cyclical fiscal package and drives US interest rates and the US Dollar higher 2, pressures on emerging market economies would possibly broaden and intensify leading to increased financial stability risks.1 Analysis suggests that in the medium term, there is a 5% probability that emerging market economies will experience portfolio debt outflows of US$100 billion or more – a level similar in magnitude to outflows experienced during the global financial crisis a decade ago.1

There are other potential factors that could cause a sharp rise in stability risks as we look ahead.1 These include a broader escalation of trade tensions, a no-deal Brexit, renewed concerns about fiscal policy in some highly indebted Euro area countries, and a faster-than-expected normalisation of monetary policy in advanced countries.1

Due to potential rising risks, the IMF has downgraded the projected 2019 growth in advanced economies by 0.1% including downgrades for the Euro area, the United Kingdom and Korea.2 The negative revisions for emerging and developing economies are more severe at 0.4% for 2019.2

The revisions for emerging markets are geographically diverse, however, encompassing important economies in Latin America (Argentina, Brazil and Mexico), emerging Europe (Turkey), South Asia (India), East Asia (Indonesia and Malaysia), the Middle East (Iran) and Africa (South Africa).2 Broadly, the IMF sees signs of lower investment and manufacturing, coupled with weaker trade growth.2

The investing conundrum

So what do you do as an investor in such times of uncertainty?

It is natural to get spooked and start questioning your investment strategies during volatile times.7 However, it is important to realise that market volatility is inevitable – it is the nature of markets to go up and down.7 Trying to time the market is difficult, so a better solution is to maintain a long-term view of your investments and ignore the short-term fluctuations.7

Staying invested in times of market volatility may seem counterintuitive, but it may potentially insulate you from losses associated with trying to time the market.8 It is almost impossible to time the top to determine when to get out, and just as difficult to recognise the bottom and when to get back in and invest again.8 Attempting to time your investment moves in tandem with market fluctuations rather than staying the course can further increase your losses during these volatile times.8

Taking a contrarian view, market volatility can create opportunities, which you can use to your advantage as an investor.8 Volatility can provide discounted entry points for investors whose time horizon and investment strategy is long-term.8 In effect, you will be lowering the dollar-cost averaging of your investments.8

It is also a potential opportunity to invest in assets you may have on the sidelines, and liquidate and redeploy underperforming assets to put your money to work while the opportunities present themselves inline with your risk tolerance and overall long-term investment portfolio strategy.8

…Asian emerging markets have been resilient economically compared to other emerging economies…

Seeking out opportunities

Amidst volatility and potential downside risks in the market, there are still opportunities for investors. Although emerging markets and developed economies are facing headwinds, HSBC Global Asset Management believes emerging market fundamentals remain robust and the global growth story is still intact.9 HSBC Global Asset Management expects periodic weakness to create opportunities to target undervalued “bright spots” in emerging market assets.9

There has been a clear loss of economic growth momentum in emerging market countries in 2018, but the deterioration has not been uniform across the emerging market space according to HSBC Global Asset Management.10 Asian emerging markets have been more resilient economically compared to other emerging economies, and corporate earnings have also been stronger in Asia compared to Latin America.10 Meanwhile, there have been signs of weakness in other emerging markets outside of Asia including a deteriorating trend in Latin America growth.10 Expected interest rate hikes from the US Federal Reserve and the expected end of quantitative easing in Europe will likely reduce global liquidity, which presents bigger downside risks to economies with weaker fundamentals.10

As a result, HSBC Global Asset Management has downgraded emerging market equities from overweight to neutral, but remain overweight on Asian emerging market equities (ex-Japan) on the back of comparatively robust economic growth in the region compared to other emerging markets like Latin America, and better structural characteristics.10 HSBC Global Asset Management is also overweight on emerging markets local currency bonds with the belief that prospective returns remain relatively attractive including returns on offer from emerging markets currency exposure.10

Beyond that, HSBC Global Asset Management remains overweight on developed Asian equities including markets like Japan, Singapore and Hong Kong. Prospective returns are attractive, valuations are favourable and corporate earnings growth remains strong.10 Relative valuations for Japan is particularly attractive whilst policy is supportive.10 Large corporate cash reserves provide firms with the scope to boost dividends or engage in stock repurchases. The trend in earnings growth remains positive as well.10

Elsewhere, HSBC Global Asset Management sees opportunities in European 11 and global equities.10 European equities look very attractive on a relative basis as they have been under performing their developed market peers due to reduced growth momentum, tighter financial controls, higher inflation and geopolitical/trade-induced volatility.11 Having seen the largest outflows of any region in recent months, Europe has been neglected and has become increasingly undervalued.11 HSBC Global Asset Management believes the macroeconomic environment in Europe remains supportive for relatively uniform earnings growth over the next 12 months as we move into 2019.11

Based on current valuations, investors can potentially benefit from global equities as the current macroeconomic backdrop remains supportive for risk assets and the corporate sector continues to be robust.10 In what can be seen as a positive sign for the asset class, global equity markets edged up in September 2018 with investors broadly shrugging off escalating trade tensions between the US and China.10 HSBC Global Asset Management believes global equities still offer attractive rewards amidst the risks to the global growth outlook.10

To learn more about where the global economy and markets may be heading in 2019, and how you can position your investments to potentially take advantage of the market ups and downs, speak to your Relationship Manager today.

Sources: 1World Economic Forum, Ten years after the financial crisis, the global economy is stronger but vulnerable, 10 October 2018. 2World Economic Forum, The IMF has a warning about global growth, 10 October 2018. 3Reuters, Global economic outlook is darkening: Kemp, 14 August, 2018. 4CNBC, US and China could soon prompt a ‘big slowdown’ in global growth, former bank regulator warns. 5Channel News Asia, ‘Window of opportunity narrowing’ on global growth: IMF, 14 October 2018. 6The Guardian, Global economic growth has peaked, warns OECD, 20 September 2018. 7Investopedia, Tips for investors in volatile markets, 30 January 2018. 8CNBC, How investors can take advantage of market volatility, 3 April 2018. 9HSBC Global Asset Management, Where there is volatility, there is opportunity, August 2018. 10HSBC Global Asset Management, Investment Monthly: Within EM equities, Asia remains a positive story, 2 October 2018. 11HSBC Global Asset Management, Europe Insights: ECB on track for a cautious normalisation, September 2018.