Rising Potential

of The World’s Largest Asset Class

Gain insights on the global real estate market and

how it can potentially grow your wealth for the future

| Real estate is an important part of many of our lives and serves different needs for different people. For some, real estate serves not only as our home but a repository for our life savings as well.1 Beyond providing a roof over our heads, real estate is a defence against poverty in old age, a potential legacy that we can leave to our next generation, and a collateral that we can use to raise funds.1 | For those with the financial capability, real estate is often an investment of choice. Both residential and commercial properties have come into focus as potentially rewarding sources of income and capital growth.1 As more people from new and emerging countries grow wealthier and seek homes and savings vehicles, it is not surprising that real estate has become an increasingly important global asset class.1 |

|

|

|

|

Real estate value increased 5% |

Income-generating capability |

Most net effective yields |

|

Source: HSBC Holdings plc, Global Real Estate: Trends in the World’s Largest Asset Class, July 2017. |

||

Growth in value of global asset classes over 2016(in USD terms) |

||

|

|

|

|

CommercialProperty

|

ResidentialProperty

|

Agricultural &Forestry Property

|

|

|

|

Gold |

Equities(FTSE Global all cap index) |

Bonds(Bloomberg Barclays Global aggregate bond index)

|

|

Source: Savills World Research, December 2016.

|

||

The World’s Largest Asset Class

| Global real estate value increased 5% at the end of 2016 over the previous year registering a total value of US$228 trillion after taking away the effects of inflation, making it the world’s most important and largest asset class. In fact, global real estate was a more valuable asset class than all stocks, shares and bonds combined – the value of stocks, shares and bonds together amounted to only US$170 trillion in 2016.1

With world GDP (at constant prices) growing by 2.3% between 2015 and 2016 to US$74.6 trillion, the world’s real estate asset values have grown faster than total global production.1 Globally, we own real estate assets worth more than three times the value of the world’s overall annual output of goods and services.1

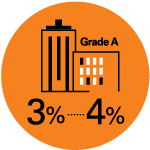

The value of real estate has risen significantly since the global financial crisis of 2007-2008.1 In the low interest rate environment we now live in, real estate has performed well along with assets like commodities, equities and bonds.1 Real estate’s income-generating capability from rents around the world has made it attractive compared to interest rates available from most bonds and deposit accounts.1 With effective yields of Prime |

Grade A offices in cities like London, New York and Sydney ranging between 3% to 4% at the end of 2016, real estate provided more attractive yields compared to local government bonds globally.1

While real estate investors may have looked for capital growth from real estate historically, the true value of real estate to investors today is its attractive prospect for rental growth in the global search for income.1 Real estate seems to have taken on a new role in global investment portfolios and has become increasingly popular as an income-producing asset, particularly among funds that need to provide pensions to ageing investors in developed economies.1 |

Residential Growth Potential

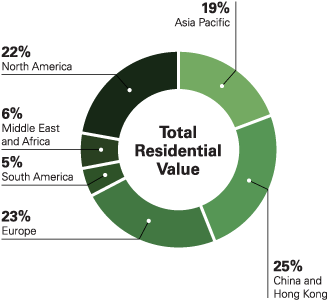

| Most of the value of global real estate is in residential property, which accounts for three quarters of all real estate stock.1 However, since most of the world’s households are homeowners, only an estimated 34% of global residential property is “investable” – meaning capable of being let to occupants and traded between investors.1

Residential property markets in most countries have seen capital growth over recent decades often in excess of local income growth.1 The highest value residential properties are concentrated in developed economies mainly in North America and Europe.1 |

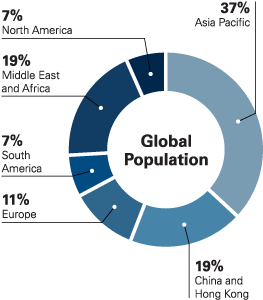

Looking ahead, the greatest growth potential for residential property is in emerging and developing economies outside of Asia.1 Much of Asia has already seen real estate asset price growth as GDP per capita has grown.1 Africa appears to have the greatest potential for value growth as national economies and household incomes increase.1 The Middle East and Africa region currently has 19% of the world population but its residential property is only worth 6% of the global total.1 |

Global residential property: total value compared to population

|

|

|

Source: Savills World Research, December 2016. |

|

Big Ticket Trading

| Trading in 2016 of big-ticket real estate was affected by global headwinds. Geopolitical issues took over from global economic conditions in 2016 as the major driver of trading behaviour in real estate.1 There was a lack of appetite to trade, particularly in the second half of the year when populism in politics and uncertainty around Brexit and other Eurozone issues increased perceived risk.1

Real estate investment into the UK fell by 38% in 2016 and investment in the rest of the European Union by 21%.1 North American cities withstood the global headwinds better with real estate trading in the Americas falling by just 5% in 2016.1 |

At a global level, the real estate industry is learning to live with a higher degree of risk resulting from political uncertainty ranging from the results of the US presidential election to the political landscape in Europe.1 With so much of the world’s big-ticket real estate concentrated in the affected regions, this is significant for the industry and may mean that Asia could benefit from a shift in global real estate trading.1 |

Trends Shaping Real Estate

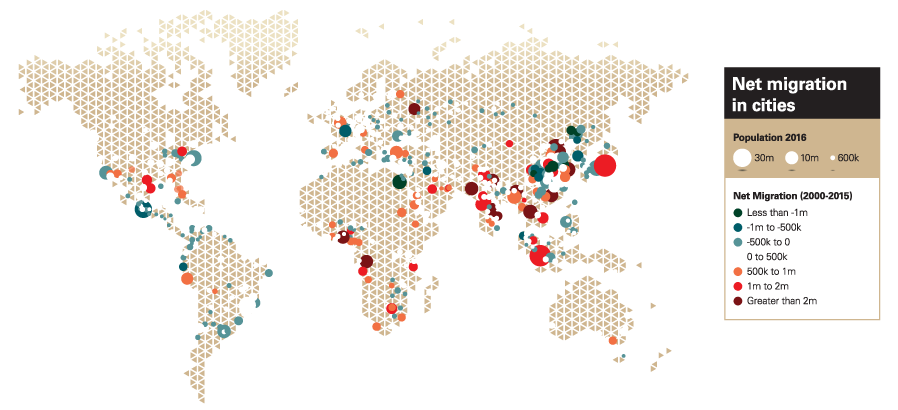

Two key factors are shaping the global real estate market – migration and education.1

| At a global level, migration has flowed from rural to urban areas, and from small cities to big ones.1 This pattern has been strongest in less-urbanised emerging economies rather than in more urbanised developed economies.1 These migration and urbanisation patterns have been important drivers of real estate markets and real estate investment in the last two decades.1

The largest population movements to large cities, particularly in Asia, have been domestic.1 This influx of human capital fuels the city economy so that, in many cases, city GDP growth exceeds that of the host nation.1 The biggest gains in internal population shifts from rural areas to urban ones have been in emerging economies of Sub-Saharan Africa and Asia, particularly China and India.1

In developed countries in North America, Europe and Australasia, cities have grown very little in contrast, and have sometimes slightly shrunk in size.1 The reason for this is partly that people are ageing in these countries and do not have the same propensity as younger generations to dwell in urban areas.1 |

Cities in developed countries are also often fully built-out and physically constrained so they have less room for growth than those in emerging or recently developed economies.1 Where demand from incoming residents, workers and visitors have been strong, this has often pushed up land and property values substantially.1

Very recently, a new pattern of migration has started to appear in some ultra-mature cities.1 Young people, in particular, have been moving from large costly cities to nearby smaller, cheaper locations.1 Some big, western cities are therefore becoming dispersed as small towns and cities around the big city, forming part of an economic ecosystem rather than a single-city economy.1 |

Source: Savills World Research using Oxford Economics, December 2016.

| All this serves to illustrate the complex world in which some of the most popular real estate markets operate.1 It shows how you need to understand underlying population trends as well as economic trends before investment decisions are made.1 Investor success nearly always lies in anticipating which locations will see strongest occupier demand for all types of real estate, and in which location supply is most constrained.1

The second factor shaping global real estate is education cities.1 These cities with high-ranking universities and top-notch schools attract a certain number of parents buying accommodation for their children.1 This can be either for their attendance at a particular institution or, increasingly, before they even enrol.1

Such purchases will often be for large apartments suitable for letting to other students before, during and after attendance by family members. In these circumstances, the rental yield may be a major consideration before investment is made.1 |

Another category of “educational purchase” is apartments and houses purchased for students as well as for use by other family members on visits and vacations.1 This is especially the case for students a long way from home.1 These purchases will likely be of a type, size and quality not often associated with lone student living and in locations not traditionally associated with low-cost student accommodation.1

The most attractive cities for buying a property for education are those home to top-ranking universities.1 Even more desirable are large, world-class cities with strong economic activity and top-ranking institutions.1 These cities give the greatest scope to rent out the property when not in use by owners.1 |

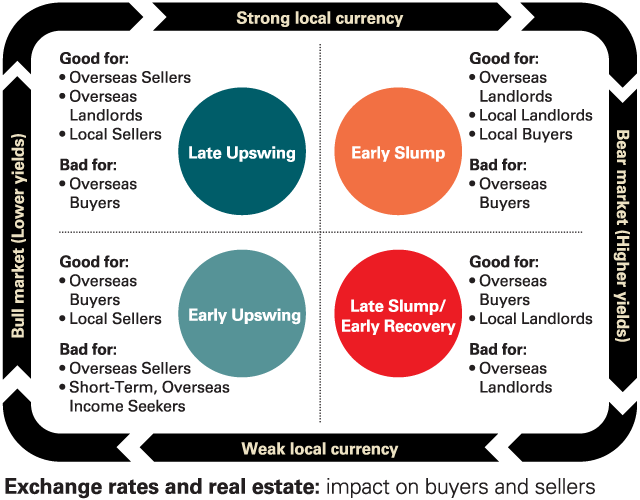

Exchange Rates and Real Estate

| Fluctuating exchange rates can present both a risk and an opportunity to enhance real estate returns for those buying in foreign countries.1 Purchasers will tend to spot buying opportunities when the purchasing currency is cheap and consequently real estate is more attractive in home currency terms.1 This can add an additional dynamic to housing markets popular with overseas investors.1

Bear markets caused by an economic downturn will usually coincide with a weak currency.1 In these circumstances, foreign currency buyers are often the first to reinvigorate a market where they foresee sound long-term demand fundamentals.1 Those looking for capital growth may be further encouraged by a currency play if they believe the value of the purchasing currency is likely to rise against their home currency.1 |

This strategy has a disadvantage for those seeking regular income from their investment in their home currency.1 Low exchange rates may make a property look like a bargain at point of purchase but continued poor exchange rates will diminish any rental income derived from it.1 As a consequence, higher yields are often sought at this stage of the cycle by buyers – often implying that a bargain is required before this type of investor is encouraged to buy.1

In bull markets where both the property and currency have gained in value, foreign owners may be more inclined to sell and take profit.1 This can create renewed activity in local markets which otherwise would have been stagnant at this stage of the cycle.1 The activity of foreign sellers then alleviates the “rarity value” created in low turnover but high-demand markets by pushing prices down.1 |

|

|

|

| In the same bull markets, overseas owners investing for income rather than capital growth may be more inclined to delay profit taking in order to enjoy a currency-enhanced income instead.1 This means they risk missing a selling opportunity if the market and/or the local currency heads south.1 More strategic investors may be more likely to take a long-term view, holding for more than one property cycle, and the most sophisticated may consider using hedging products to reduce their currency risks.1

One good example of how exchange rates affected global real estate in 2016 was the Pound Sterling’s fall as a result of Brexit.1 At one point during 2016, Pound Sterling-denominated assets looked 19% cheaper compared to the rest of the world than at the beginning of the year.1 |

This may have been good news to potential buyers as they received an instant discount on their purchases from the currency markets, but bad news for overseas owners of UK properties who saw the dollar value of their holdings fall.1

Prime London residential prices fell 5% between Q1 2016 and Q1 2017.1 When the devaluation of the Pound Sterling is factored in, the discount is even greater for many overseas buyers.1 For example, when you factor in the devaluation of the Pound Sterling against the Malaysian Ringgit between Q1 2016 and Q1 2017, and add in the 5% price dip, Malaysian buyers would enjoy a 12.8% discount on London residential properties, according to the Savills World Research using Bank of England quarterly average spot exchange rates as cited in HSBC Holdings plc, Global Real Estate: Trends in the World’s Largest Asset Class, July 2017.1 |

|

|

|

Cost of buying a £1m prime London property in foreign currencies in Q1 2017, accounting for FX movements when compared to Q1 2016. Source: Savills World Research using Bank of England quarterly average spot exchange rates. |

Prospects for The Future

| Real estate has taken a new role in investment portfolios across the world.1 Here are some themes to consider for the future as you weigh the potential real estate has within your portfolio. |

|

Search for income |

| As the world has adjusted to low interest rates and yields in the aftermath of the global financial crisis, the appetite for real estate has grown.1 The initial bounce back after the downturn has been followed by a more concerted search for income worldwide.1 This is likely to continue as more investors are looking for income rather than just growing capital.1 |

|

Solid asset amidst uncertainty |

| In these uncertain times, the lure of real estate remains strong.1 In developed economies, real estate is a solid, real world asset, not easily confiscated or devalued. The established real estate of developed economies is still a reliable, transparent and safe place to store value amidst the potential threat of geopolitical uncertainties.1 In some emerging economies, real estate is becoming an increasingly transparent and secure asset class.1 This means it is gaining in popularity among a growing number of investors.1 |

|

Value is the new quality |

| There will be less distinction between what is considered ‘core’, ‘value-add’ or ‘opportunistic’ as occupier demand changes and investor appetite shifts.1 If investors pay attention to demand and occupier fundamentals rather than old conventions, there is no reason why these investments should be any more risky than conventional asset classes, with performance to match.1 |

|

Rise of new global cities |

| The locations in which to invest are changing too.1 Smaller cities are rising on the global stage to compete with the global megacities.1 Driven by expanding tech industries, Austin, Tel Aviv, Berlin, San Francisco and Melbourne, for example, are all on the rise.1 Offering their residents a high quality of life, lively social scenes and lower costs than top-tier global cities, they have been successful in attracting globally mobile talent.1 This, in turn, is fuelling demand for real estate.1

In developed economies, real estate is a solid, real world asset, not easily confiscated or devalued.

Whether you are interested in investing in global real estate directly or through funds, HSBC is in a position to provide you with the assistance you need. As a global bank, we have a comprehensive suite of foreign currency and international banking services ranging from global currency transfers, multi-currency accounts and international client onboarding to seamless credit history transfer from one country to another. Depending on the country, HSBC can also provide mortgage services as well as protection plans for your real estate.

Property/Real Estate Funds provide an alternative to direct real estate investment.2 Advantages of global real estate funds include better liquidity, lower entry point with small lot sizes, specialist local expertise and lower transaction costs compared with direct real estate investment.2 |

To find out more, speak to

your Relationship Manager today.

• Sources: 1 Reproduced from a report written by Savills World Research, a division of Savills (UK) Limited, with permission from Global Real Estate: Trends in the world’s largest asset class, published in July 2017 by HSBC Holdings plc. HSBC is a trademark of HSBC Holdings plc and all rights in and to HSBC vest in HSBC Holdings plc. Other than as provided above, you may not use or reproduce the HSBC trademark, logo or brand name, July 2017. 2 HSBC Global Asset Management, HSBC GIF Global Real Estate Equity, Q1 2017.