EPF Savings

How to make the most out of it

As far as savings go, the Employees Provident Fund (EPF) is probably the most prevalent form of savings for working Malaysians. Most hardly even feel the pinch, with the recently readjusted 11% taken from their monthly salaries before they even see the money. Then to top it off, employers contribute a minimum of 12%1 to the employees’ accounts. The objective is to ensure that Malaysians have funds for their later years, when they stop earning a regular income.

The EPF declared a dividend rate of 5.65% in 2009, better than the 4.5% in 20082. Could these conservative numbers have prompted a significantly larger number of EPF members to opt to withdraw part of their retirement savings to invest in unit trusts? According to a report by The Star3, the amount withdrawn from EPF savings for unit trust investments in the first quarter of 2010 rose by 43.26% to RM911.15mil from RM636.01mil withdrawn in the corresponding period in 2009. The number of applications approved under this withdrawal increased to 113,809 from 87,420 in the corresponding period, the first quarter of 20093.

Corresponding to that, in a survey by Personal Money magazine in August 2009, 71% of respondents withdrew their EPF savings to invest in unit trust funds, with 62% reporting returns that are higher than EPF annual dividends4.

Before you start managing your own savings or manage them with the help of fund manager, there are crucial factors that you should consider before investing your EPF savings.

What’s Your Investment Capability?

If you are unsure and do not have the skills for investments, it may be better for you to leave your EPF funds untouched. Over the past 5 years, EPF has on average provided a 5% return on your savings5, which is higher than conventional deposit accounts, and with minimal risk. Should you opt to withdraw your EPF funds, you may be assuming more risk although the returns could be potentially higher.

What’s Your Goal?

Ideally, your EPF savings should fit into your overall investment strategy. It would be helpful to consider your EPF savings as part of your total portfolio, with investments ranging from conservative to aggressive as well as covering different asset classes. If you already have funds in more aggressive investments, you may want to consider leaving your EPF savings intact as part of the conservative portion of your portfolio. Should you have already invested in other conservative investments like Fixed Deposits, it may be helpful to use your EPF savings for investments to possibly bring in higher returns. However, if you do withdraw your EPF savings for investments, do consider setting goals for your target returns, aiming for returns higher than the average EPF dividend rate of 5%. Also, you may want to consider fees and fund management costs when evaluating your returns.

How Near Retirement Are You?

The next factor would be your age and how near you are to retirement. If you are young and have a long investment time frame, you may want to take on more risks. However, if you are just a few years away from retirement, it may be time to wind down and protect your capital. In such a situation, you may want to shop for a reliable fund manager to manage your money and invest in instruments that protect your capital while providing regular retirement income.

But let’s say, after careful consideration, you do want to take the route of withdrawing and investing part of your EPF savings, where do you start? We’ll cover three popular options – unit trust funds, property and retirement plan – to help you potentially maximise your EPF savings.

Option 1: Growing Your EPF Funds Via Unit Trust

The most important consideration when investing your hard earned money in unit trusts is selecting the right fund(s) and the right fund manager(s).

We recommend that you read and understand the fund prospectus, company annual or interim report and risk profile of the fund prior to making an investment decision. Generally the higher the returns the higher the risks will be. Consider the general risk factors associated with investing in unit trust funds in addition to other specific risks uniquely associated with the fund. All the relevant risks are set out in the relevant prospectus for the fund. If in doubt, consult a qualified adviser.

While past performance is not indicative and may not be a guarantee of future success, it can serve as a good barometer to evaluate a fund’s consistency and how it has been managed over time. Looking at its long-term track record may help you uncover the manager’s skill and expertise in managing the fund through different market cycles.

Pay attention to fees and charges involved, which can erode your total returns. Some fees and charges to take note of are Initial Service Charge, Exit Fee and Annual Management Fee.6 Some fund houses allow free switching between funds that they manage. This may be useful in helping you to capture market upswings and lock in gains.

Apply the Dollar-cost-averaging strategy as EPF allows regular quarterly withdrawals. By investing regularly, you may end up buying more units when the price is low and fewer units when the price is high. Over time, you lower the average cost per unit.

Diversify through different types of funds to suit your investment strategy. However if you are just starting out, stick to a few good funds and learn the ropes from there.

Option 3: Investing In Retirement Plan

We’ve heard it often enough – that a large majority of EPF members deplete their savings within 3 years of withdrawal from age 55.7 To address this situation, EPF has introduced the Flexible Age 55 Withdrawals to allow members to better manage their funds.8 Basically, there are 3 ways to access your EPF money upon retirement: lump sum withdrawal at age 50 and age 55, ad hoc and monthly. For the lump sum withdrawal at age 50, you can withdraw your entire Account 2 savings only. At age 55, you can withdraw your entire savings from both Account 1 and 2. You can have a mix of these methods as long as you observe the interval periods prescribed by EPF. You would need to reach age 55 and have a savings balance with EPF to apply for this withdrawal.

With this flexibility, there is more you can do with your retirement funds, such as reinvesting them in a retirement plan such as Takaful Retirement Plan. This plan is designed to provide you with a regular stream of income up to age 75 or the duration as stated in the plan, in exchange for a sum of contribution. Depending on the plan, it also provides you with insurance coverage and income payment to you or your loved ones after your demise. The benefit of having this type of retirement plan is to enjoy receiving regular income, even when you have ceased from active work life.

For example, at age 55 Ahmad withdraws a portion of his EPF savings and makes a single contribution of RM100,000 to the Takaful Retirement Plan with a 10-year accumulation period.

Then at age 65, the Takaful Retirement Plan begins to provide a regular annual income of RM11,300 (11.30% p.a.) up until he reaches the age of 75.

At age 75 and maturity of the plan, he also gets a Maturity Bonus of RM44,865.9

By reinvesting a portion of his EPF, he has managed to increase his savings and stretch his ringgit for many more retirement years with added protection, compared to withdrawing his EPF savings and placing them in a conventional savings account.

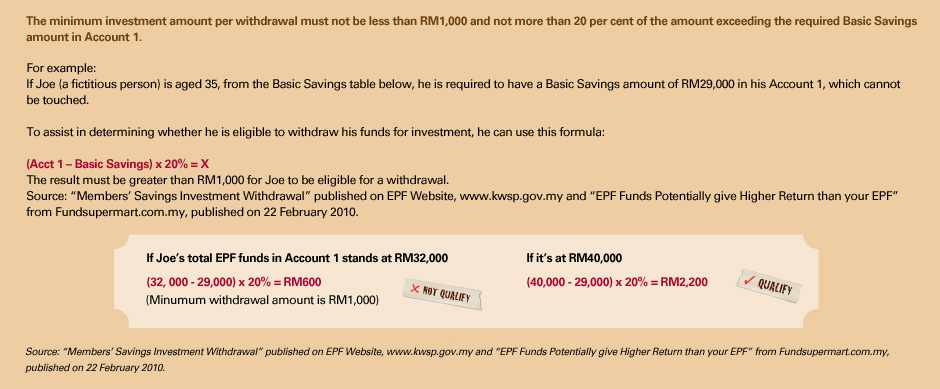

Do you qualify for EPF Investment Withdrawal?

According to EPF, you may qualify for Investment Withdrawal if you meet the following criteria:

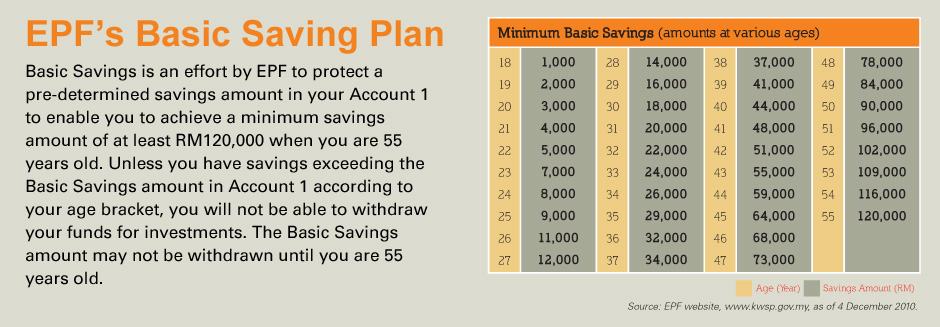

- EPF investment withdrawals are only applicable to members who have savings of at least RM5,000 more than the Basic Savings amount required in Account 1. Basic Savings is the minimum amount of savings you must have in your EPF Account 1 before you are allowed any withdrawals for investments. (Please refer to the Basic Savings Table)

- You have reached 50 years of age but have yet to reach the age of 55 at the time the EPF received your application.

- No direct investments are allowed, such as withdrawing the savings to your own account and investing them in unit trusts. You are also not allowed to make additional investments using your own money.

- Members can invest part of this savings in unit trust through external fund managers appointed by the Ministry of Finance.

- Investment withdrawals can be made every 3 months after the date of the last application is approved, subject to the availability of the required balance in Account 1.

1. ‘Changes in EPF contributions rates since 1952′ published on EPF website, www.kwsp.gov.my.

2. ‘EPF Declares 5.65% Dividend For 2009′ published on EPF website, www.kwsp.gov.my as of 5 March 2010.

3. The Star, ‘More EPF members making withdrawals for unit trust plan’, 11 June 2010.

4. The Edge, Personal Money Magazine, ‘Personal Money EPF Poll’, August 2009, sample size 353 respondents.

5. The Edge, Personal Money Magazine, ‘How to Maximise your EPF’, August 2009 and Fundsupermart.com.my ‘EPF Funds Potentially give Higher Return than your EPF’ 22 February 2010.

6. ‘Understanding Fees and Charges’ from the Federation of Investment Managers Malaysia website www.fmutm.com.my

7. The Star, ‘Can you retire?’ 27 May 2007

8. New Straits Times, ‘Flexible withdrawal at age 55′ 19 Oct 2008

9. The above illustration is based on the assumption of a gross 4.78% p.a. return on investment. The projected value is for illustrative purposes only and the investment value may go up as well as down. The return of investment is neither guaranteed nor based on past performance.

10. Takaful products herein are managed by HSBC Amanah Takaful (Malaysia) Sdn. Bhd.(Company No. 731530-M) (“Takaful Operator”).

Will my EPF savings be wiped out

if I don’t nominate a beneficiary?

Let’s consider this fictional scenario. Chong has been working for 20 years and have accumulated a sizeable nest egg in his EPF. Unfortunately, Chong meets with an accident and passes away, leaving behind his wife and 2 children. What happens to his funds?

Scenario 1: He has not nominated his beneficiaries

According to EPF, if there is no nomination and depending on the amount of savings in the member’s account, the procedure as determined by EPF will be as follows:

If an EPF member’s EPF savings are less than RM25,000

Initial sum of RM2,500 will be paid to the next of kin. The balance will be paid to the next of kin after a two-month period from the date of the member’s death.

If an EPF member’s EPF savings are more than RM25,000

Initial sum of RM2,500 will be paid to the next of kin. The second payment (not more than RM17,500) will be paid to the next of kin after two months from the date of the member’s death.

The balance of the savings will be paid upon submission of the Letter of Administration / Letter of Probate / Distribution Order / Faraid Certificate to EPF from the party that administers the estates such as Amanah Raya Berhad or the Court or the Land Office, respectively. The process to obtain these documents may be time-consuming and certain fees will also need to be paid. On the other hand, with nomination, no fees need to be paid.

Scenario 2: He has not updated his beneficiaries

Chong nominated his Mom and Dad as beneficiaries when he first started working and has not updated his nomination after he is married and has children. Dad has passed on, leaving Mom as the surviving beneficiary. His marital status does not nullify his earlier nomination.

In such a scenario, as the living beneficiary, Mom will receive her portion accordingly. The portion that was bequeathed to the deceased nominee will be invalid and will be subjected to procedures under ‘EPF savings without nomination’ in which the first priority for the right to claim the member’s savings goes to the nearest next of kin or the appointed administrator of the deceased member’s estate. In this case, Chong’s Mom will receive 50% of his EPF savings, and the other 50% may be divided among his wife and children.

This is precisely why nominating your beneficiaries is very important. You should also ensure that you update your beneficiary whenever there are any major life changes such as marriage, additional new members or the death of a nominated beneficiary.

Please note that you don’t have to produce the death certificate of a deceased nominee to change your nomination. You can change or update your nomination anytime by simply completing a new KWSP 4 (AHL) Form. This will automatically revoke any earlier nomination made.

Scenario 3: No nomination but he has a will

If a nomination is made, a Will cannot override the earlier nomination, according to the Employee Provident Fund Act 1991. However, if no earlier nomination is made, then the distribution of your EPF savings will be in accordance to your Will, which is why writing your Will is also important to ensure that your loved ones are taken care of.

With a Will you will have the power to appoint someone who is trustworthy to execute your estate and distribute it according to your wishes. Your estate can be transferred speedily and smoothly to your beneficiaries, who may be left in a quandary with your demise. You can name a guardian for any young children to ensure their continued provision and support.

You can relieve the burden of family and friends at such time of grief by appointing a Corporate Executor to attend to various arrangements relating to the estate administration which may be time consuming and stressful.

To set up a Will or find out more about HSBC Will Writing and Will Custody services, please call 1300 88 0181.

Source: Scenarios are derived from “EPF Response to chain email on Nomination” published on EPF website, www.kwsp.gov.my, as of 4 December 2010.

LIKE THIS ARTICLE?

LIKE THIS ARTICLE?