The Investment Puzzler

Find the right fit for your portfolio

The term “investment” is used so often nowadays – from investments in stocks and bonds to education, cars and even antiques – that the line is often blurred between an investment and an expensive purchase. How then do we ascertain what an investment is and what may work best for you? According to Investopedia, an “investment” is defined as “something that is purchased with money that is expected to produce income or profit.”1

Let’s revisit the investment basics and get down to the core of it. In a nutshell, there are two groups of investments: ownership investments and lending investments.

Ownership investments1

These are the most volatile and potentially more profitable type of investments. In this category, the types of investments may be further broken into subcategories such as:

Stocks/Equities

Stocks/Equities

When you buy a stock, it means you own a certain portion of a company. Having a share in the company may allow you some rights such as voting at the shareholders’ meeting and receiving any profits that the company allocates to its owners. Based on the prevailing stock price, the stockholder may earn a profit or make a loss when the stock is disposed.

Business

Business

This is one of the hardest investments as it requires more than money. Being an entrepreneur is risky but it may potentially reap huge returns if the venture is successful.

Property

Property

Property investment refers to a property purchased for the purpose of generating returns in the form of rent and capital gains. It does not refer to your home.

Precious objects

Precious objects

Gold, a painting by Van Gogh and a signed Michael Jackson album can all be considered ownership investments, provided that they were bought with the intention of reselling them for a profit.

Lending investments1

These allow you to be the “lender” in return for profit. This category of investments tend to carry lower risk than ownership investments and as a result, the returns may be more modest.

Savings/Fixed deposits

Savings/Fixed deposits

You may not have thought much of your savings account or fixed deposit but having them qualifies you as an investor. Essentially, with the account, you are “lending” money to the bank in return for a fixed amount of interest/ profit. The bank may then lend out your money in the form of loans.1

Bonds

Bonds

These are a type of security that is founded on debt and are usually issued by a company or government. When you purchase a bond, you are acting as the “lender” to the company or government in return for an agreed upon sum of interest on your money. At the expiry of the bond, the company or government agrees to pay you back the amount you “lent out”. Bonds may be considered relatively low risk, if purchased from a stable government or company. However, it comes with a trade off – potential returns may also be low.2

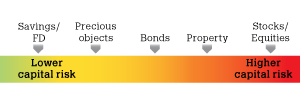

Asset class reward and risk

Each of these investments has their advantages and may serve a useful purpose in diversifying your portfolio. Which do you include in your investment portfolio? To decide on your asset mix, you would first need to understand the risks and rewards of each asset class.

How to determine your ideal asset mix

1. Your tolerance for risk

In considering the ideal asset class for you, it is essential to take into account risk and how much of an appetite you have for it. One of the most important aspects of risk is called capital risk, which is the amount in which your returns are likely to go up or down.8

Some asset classes like savings accounts have low capital risk, whilst others, such as stocks/ equities have much higher risk. If you cannot stomach too much risk, you may want to aim to hold a high proportion of your investments as cash and fixed-interest securities such as bonds. If you are more aggressive risk taker, your portfolio may have a relatively high proportion in stocks/equities.8

2. Your age matters

We would all love to earn high returns with no risk but unfortunately, that is rarely possible in the real world. In reality, to get higher returns, you may have to accept higher risk.8

How much risk should you take then? One factor to consider is your age. If you have many working years ahead of you, you may consider taking on more risk. That’s because if you do make losses, you still have years to continue growing your wealth. When you are older, your chances of recuperating from your loss is lower, so you may want to lean towards a lower risk portfolio. A popular guide is to take away your age now from 100 to determine the percentage you may want to have in equities. For example, if you are 40, the guide is 100 – 40 = 60% of your portfolio in stocks and the remaining 40% in lower risk instruments. This is only a rough guide and may not be applicable in your situation.9 If you need help in determining your asset allocation, it is best to speak with your financial guide.

3. Your investment capital and goals

Balancing the above two factors with your investment goal may allow you to craft a suitable asset mix across different asset classes. The other factor to look into is your available capital as the basis for your asset composition. If you have a long time horizon with a large capital, you may feel more comfortable with high risk, high return options. If you have a smaller amount to invest and a shorter time frame, you may feel more comfortable with low risk, low return allocations.10

To help you visualise the asset allocations process, we list a few types of investors with their sample allocations here. Each of these sample portfolios comprises different proportions of each asset classes.

(All characters appearing in this list are fictitious. Any resemblance to real persons, living or dead, is purely coincidental.)

Bear in mind that these sample portfolios by the different types of investors are only a loose guideline which you can use as a basis to modify from. You may then tweak the percentages to match your own personal investment strategy, your future needs for capital and investment appetite.

Setting up an allocated portfolio is just a start. It is vital to conduct regular portfolio reviews as your goals may change or the value of various assets may change over time, affecting the weighting of each asset class. If you need assistance, talk to HSBC’s Relationship Manager or walk in to any HSBC branch for help to fine tune your portfolio mix to suit your goals.

Sources:

1 Investopedia, “Defining The 3 Types Of Investments”, September 2, 2012.

2 Investing 101: Types Of Investments”, undated.

3 Investing in Funds, “Main types of investment”, undated.

4 Monevator, “A quick guide to asset classes”, May 15, 2012.

5 Fin24, “Asset classes: Know the pros and cons” undated.

6 About.com Stocks, “The Case for Staying Invested in Stocks”, undated.

7 The Sun Daily, “How does the new RPGT regime affect you?” November 25, 2013.

8 The Money Advice Service, “Asset classes explained”, undated.

9 CNN Money, “Ultimate Guide to Retirement: What’s the best asset allocation for my age?”, undated.

10 Investopedia, “Achieving Optimal Asset Allocation”, November 16, 2013.

July 2014

LIKE THIS ARTICLE?

LIKE THIS ARTICLE?