Turn Your Investment Blind Spots to Hot Spots

Tips to identify and avoid them

“In a car, the rearview mirror serves to reduce blind spots on both sides, which may help the driver manoeuvre the vehicle safely. In terms of investing, blind spots have taken into account or thought about, which may even seem obvious on hindsight.1“

While it may be impossible to totally remove investment blind spots, it is crucial to recognize them in order to minimise their effects. Consider this article your rearview mirror to spot some of your own potential investment blind spots2.

Do I see how my asset allocation affects my investment returns?

Your asset allocation should be suited to your financial goals, time horizon, expected withdrawals and other factors, while balancing your desire for the highest return with the right level of risk. Diversifying your asset into a mix of lowly or uncorrelated asset classes may spread your risk and reduce portfolio volatility, for example, stocks in the same sector may behave more similarly to each other than to stock in other sectors. So if your stocks in technology underperforms, your stake in energy, commodities, or financial sector may serve to counterweight your portfolio performance.3

Another blind spot of a poorly diversified portfolio is holding on to too much cash. Of course, there are times when holding larger cash balances make sense but over the long term, this blind spot may significantly hinder your long-term return potential. That’s because cash usually generates the lowest annual returns out of the major asset classes (eg. Equities, bonds, real estate, commodities and money market instruments).4

Besides that, another common error is for investors to set up their allocation and then forget about it. But markets are dynamic and ever changing. A portfolio needs to be monitored and reviewed to ensure that it is still performing as per your strategy.5

Do I see the right people for the right investment insights?

It is easy to listen to the friend who has hot investment tips or a family member who is the “investment guy”. But what you may not see is their asset allocation and/or their investment goals. What may work for them may not for you, as they may not share your same asset allocation or risk appetite. If you want sound investment advice, consider going to a Financial Guide/Relationship Manager who may tailor that advice to your risk tolerance and your financial goals.

Do I look into external factors that may affect my returns?

It is not easy to understand fees on investment management, which is why you may want to make an effort to look into them. Investors may not know exactly how much fees they pay and unfortunately it may often be more than they realize. According to the Federation of Investment Managers Malaysia, “the first cost that an investor incurs in relation to investing in unit trusts is the initial service charge (sometimes called the service, sales, entry, or ‘up front’ charge). This is the cost to an investor investing in unit trusts and it is levied primarily to cover the marketing and distributing units and monitoring his investments by the unit trust consultant for the duration the unit trusts is held.” Other fees may include an exit fee, when an investor disposes of an investment and an annual management fee. Always take into account the fees you have to pay, which may impact your rate of return.6

Next, taxes. Proper management of taxes may leave more money in your hands. Fortunately, due to the Malaysian Government’s efforts to promote unit trusts, most of the income received from unit trusts may be exempt from income tax. However, unit holders must file their tax credit in their income tax return to use the available tax credit to set off against their tax payable. “Any excess of tax credit over the tax payable will be refunded by the tax authorities to the unit holders,” states Malaysian Investor in its article, “Tax Planning Strategies – Unit Trust”.7

Another crucial external factor is inflation. Make no mistake – inflation has a ravenous appetite that eats into investment returns over time. By turning a blind eye to it, an investor may underestimate the level of growth required to generate the required income, which may lead to an asset allocation that is too conservative.3

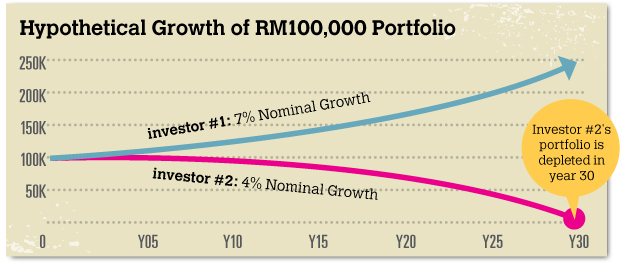

For example, let’s take a look at two investors with a starting portfolio value of RM100,000. Both investors wish to withdraw RM4,000 per annum for their retirement expenses. Inflation is set at 3% which will cause the RM4,000 annual withdrawal to increase to accommodate the rising cost of living.

Investor #1 accounts for this and builds a portfolio with a nominal projected return (before inflation) of 7%. Investor #2 fails to consider inflation and builds a portfolio with a nominal projected return of 4%, which he believes is sufficient to cover the RM4,000 annual withdrawal (4% on a RM100,000 portfolio). As seen in the figure above, the second investor’s portfolio is depleted by year 30.3

Do I look at the big picture?

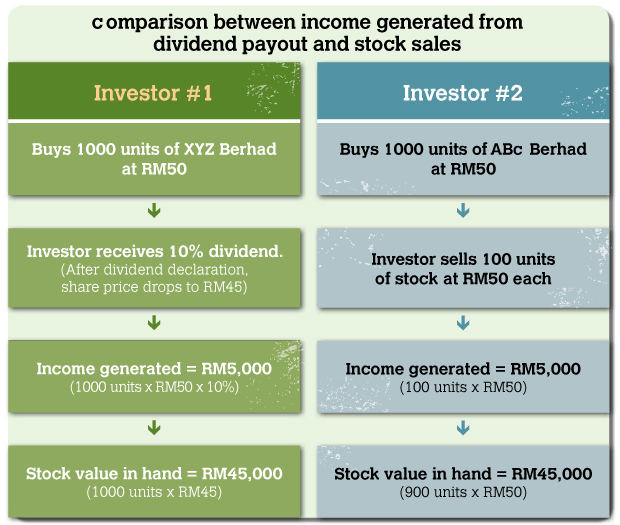

Another common blind spot in investing concerns dividends and interest income. It is the false perception that dividend paying investments generate higher returns and offer greater security compared to capital gains. That could lead to many retired investors preferring higher yielding securities so that they can fund their retirement on the interest. However, this may not necessarily be true. In reality, capital gains may provide the exact same economic benefit as dividends and interest income. Let’s take a look

at two investors again. One chooses to generate income via dividend payout and the other opts to sell his stock.

In both scenarios, the income generated is equivalent, which simply means that income may be generated from either dividend payouts or capital gains. If all things being equal, why be concerned where the income comes from? Investors need to be cautious not to place all their eggs in one basket. This failure to look at the big picture of how income may be derived could lead to a less diversified portfolio.

In an attempt to generate more income, an investor may build a portfolio around high yield stocks and may unintentionally concentrate on certain sectors. A less diversified portfolio may post a risk should the sector the investor focuses on takes a downward turn. As with any investment, there is no guarantee that higher yielding investments will outperform their lower yielding counterparts over the long-term. Looking at the big picture and opting for a diversified mix of both interest income and capital gains may reduce your portfolio’s exposure to unnecessary risk.3

Did we uncover any of your investment blind spots? If so, perhaps it is time to chat with your Relationship Manager to adjust your portfolio to truly reflect your investment goals and strategy.

Source: 1 The Economic Times, “Six simple tips to remove blind spots in financial planning”, August 11, 2011. 2 Forbes, “7 Investing Blind Spots to Watch Out For” October 15, 2010 and “The Seven Deadly Investor Sins” February 7, 2013. 3 Forbes, “The Seven Deadly Investor Sins” February 7, 2013. 4 Forbes, “The Seven Deadly Investor Sins” February 7, 2013, Investopedia.com, “Asset Classes Definition” (undated). 5 Forbes, “7 Investing Blind Spots to Watch Out For” October 15, 2010. 6 Federation of Investment Managers Malaysia, “Understanding fees and charges,” (undated). 7 Malaysian Investor, “Tax Planning Strategies – Unit Trusts” (undated).

LIKE THIS ARTICLE?

LIKE THIS ARTICLE?