Money and Marriage:

Making it work at home

.

“For better or worse … for richer or poorer … “Some couples begin life together after exchanging vows along these lines. But managing finances is easier said than done. For one, their individual money management styles may not mesh with each other. One may bring more debt into the marriage than the other, causing resentment to build. Or the spouse may perceive his/her partner as the big spender who is delaying their financial goals and future dreams.

Let’s face it – men and women are different!

In the area of money management there is no exception. These differences may bring on arguments or they may serve to complement each other. Understanding these differences may be the first step towards greater financial harmony. “The Future of Retirement 6”, an independent survey by HSBC Group in 2011, reveals how men and women handle finances differently:

Women live longer

As one spouse may outlive the other, there is a need to plan better for retirement and especially protect the future of the family with insurance. The average life expectancy of Malaysian men is 71.7 versus 76.6 for women3.

Women have less for retirement

According to the EPF 2010 Annual Report (at the age of 54), men recorded an average savings of RM 163,977.05 versus women’s average savings of RM 111,497.63. One of the reasons is that women are far more likely to stop working full time when they have children (47% compared to 15% of men.) Coupled with their conservative savings behaviour and lack of retirement planning, women may end up with far less than what they need to retire well4.

So how do couples work around the differences and come out stronger financially as a couple? Here are a few tips that may be helpful in the process of integrating finances as a couple.

Is talking about money important to you?

It’s important to me.

Understand each other’s views of money and uniqueness in managing it. It is not about asserting who has the right or wrong way but to come to a workable compromise. You may decide if it is important enough for the two of you to set periodic weekly or monthly “money talks” to keep tweaking and optimising your money method.

What’s the future for our money?

Decide on financial goals – for the short, mid and long-term. Put shared goals ahead of your individual desires, (example, saving for your children’s education versus buying limited edition designer handbags). What are some of the investments and risks you are willing to take on as a couple? How about protecting and assuring the future of your spouse? It may be a good idea to take time to learn to adapt and work as a team.

How do we spend our money?

It is likely that your views regarding money and spending will differ from your spouse’s, so the process of creating a budget can help you both clarify what is important and how to allocate your resources. You may want to talk about housing, groceries, utilities and essential expenses before moving on to discretionary funds. What are some budget controls you want to set into place? For example, any decision on purchases above X ringgit may be made jointly.

How do we handle debt?

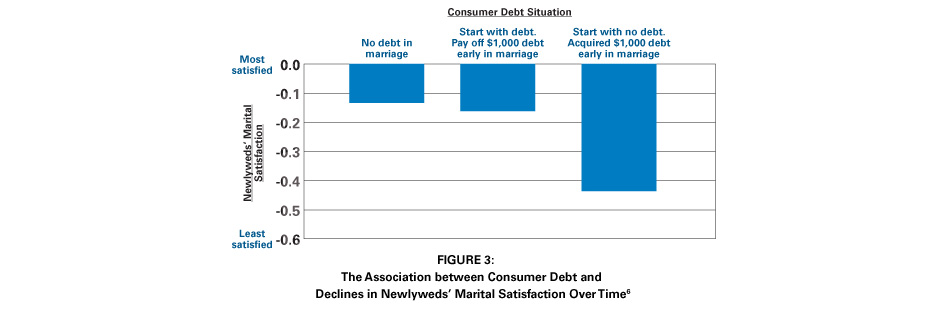

Research has shown that debt has the ability to erode the quality of married life over time. In a survey conducted by the Utah State University, USA6, it states that “consumer debt fuels a sense of financial unease among couples, and increases the likelihood that they will fight over money matters; moreover, this financial unease casts a pall over marriages in general, raising the likelihood that couples will argue over issues other than money and decreasing the time they spend with one another. For instance, as Figure 3 indicates, newlywed couples who take on substantial consumer debt become less happy in their marriages over time. By contrast, newlywed couples who paid off any consumer debt they brought into their marriage or acquired early in their marriage had lower declines in their marital quality over time.” If debt is unmanageable, seek the services of a financial consultant to develop a personalised debt repayment plan to regain control of your money.

Who does what?

Specify your roles and don’t leave each other guessing or squabbling over unfulfilled financial obligations. Share the responsibility instead of expecting one spouse to shoulder all of it. Also, play on each other’s strength. If you’re better with investments, perhaps you may be the person to research into investment options for your family. Alternatively, your spouse may be more disciplined financially, which may be better suited to take care of bill payments and other household expenses. You may also want to sign-up for HSBC’s Personal Internet Banking and explore HSBC’s Bill Payment services for more efficient settlement of your outstanding bills.

A joint account with equal contributions: This is useful if you and your partner are on par in earnings and can contribute equally to the account. What’s left over may be kept in your personal accounts and used as you wish.

A joint account funded by the partner who makes significantly more money: In situations where one partner makes significantly more than the other, he or she could opt to contribute a fixed amount to the joint account. The remainder may be for personal use. The partner who earns less may keep his or her earnings and use it as he or she wishes.

A joint account with proportional contributions: Another method is to fund the account according to the proportion of household income. For example, if the husband earns 70% of the household income, he may contribute 70% of the required funds into the joint account.

A joint account with monthly allowance: In this model, both partners put their entire salary into the joint account. If couples have a flexible home loan to be paid off in the bank, such as HSBC HomeSmart. Then, they can actually use this flexible home loan account as their joint account whereby they can withdraw a fixed, mutually agreed upon “allowance” from the account every month for their own discretionary spending. This model works very well as the surplus money in the home loan account will reduce the loan interest payable and also help customers to pay off their loan faster.

Source:

1. The Future of Retirement 6 – Why Family Matters (HSBC’s Global Report 2011).

2. The Future of Retirement 6 – Why Family Matters (HSBC’s Malaysia Report 2011).

3. Department of Statistics, “Life Expectancy at Birth 2010.”

4. EPF 2010 Annual Report, “Average Savings at Age 54”, The Future of Retirement 6 – Why Family Matters (HSBC’s Global Report 2011).

5. daveramsey.com, “The Truth About Money and Relationships”, 3 August 2009.

6. Research by University of Utah, USA, “Bank on it: Thrifty couples are the happiest” (2009), by Jeffrey Dew, a faculty fellow at the National Marriage Project and an assistant professor of Family, Consumer, and Human Development at Utah State University.

7. moneyland.time.com, “Should Married Couples Merge Finances or Keep Them Separate?” 28 July 2011.

LIKE THIS ARTICLE?

LIKE THIS ARTICLE?