Bonds

A Wealth of Opportunities

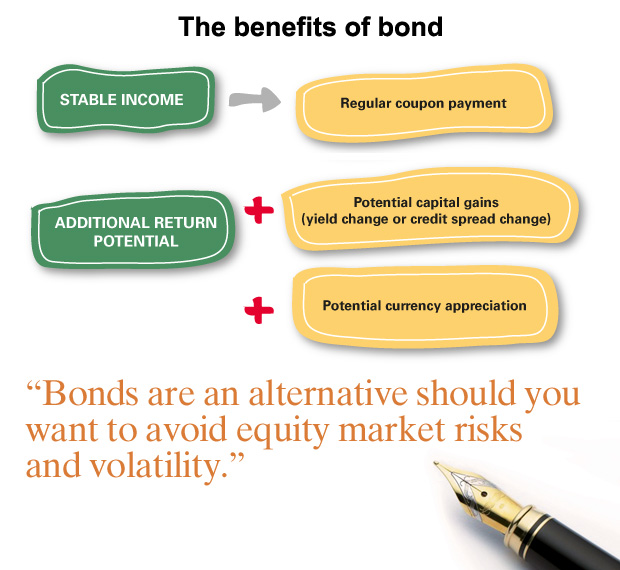

Bonds make sense when it comes to retirement planning, as they generally offer periodic cash flows in the form of coupon payments, as well as principal repayment at maturity, provided that there is no default by the issuer. What is more, bonds are an alternative should you want to avoid equity market risks and volatility.

A bond is a debt security issued by a corporation or government, with a stated interest rate and specified dates when interest and principal must be paid. In a nutshell, bonds are an instrument for companies to “borrow” money by issuing bonds to investors to fund their working capital requirements or for business expansion purposes. In return, the investor receives coupon payments (interest) periodically and the principal value of the bonds at maturity provided there has not been any default by the issuer.

Key facts you should know about Bonds

The possibility of default risk

Default risk occurs when the bond issuer fails to repay the principal or make coupon payments as agreed. At times of market downturn, an issuer may default due to their inability to raise new debt to roll over or repay old debt. The coupon payment and principal payback are not guaranteed. Nevertheless, historically, the default rate for investment grade bonds is extremely low. Only 3.1% of BBB-rated bonds and 0.2% of AAA-rated bonds on average have defaulted within 5 years during the period of 1920 to 2007.1

Subject to liquidity risks

When bonds are first issued, they are sold in the primary market directly from issuers. If a buyer decides to liquidate his investment before its maturity date, the bond can be traded in the secondary market. This may expose the buyer to liquidity risk which means that it is difficult to sell the bonds at an equitable price, with the possibility of losses.

If you are interested in investing in bonds:

- Talk to your Relationship Manager

- Call us at 1300 88 0181

- Click www.hsbc.com.my

Source:

1. Moody’s 2008 annual default study. Implied default rates: Deutsche Bank, 2008.

LIKE THIS ARTICLE?

LIKE THIS ARTICLE?