7 Habits of Highly Effective Investors

In his bestseller, 7 Habits of Highly Effective People, Stephen R. Covey presented a principle-centered approach for personal and professional development. The underlying principles that Covey shared may similarly impact us in the area of investment and here is how we applied Covey’s 7 famous habits1.

Habit 1: Be pro-active

Being proactive means assessing the situation and developing a positive response for it. Instead of reacting to economic changes around you, you may choose to use your resourcefulness and initiative to find solutions. In investment terms, that could mean assessing your financial situation and developing a financial plan. You could also stay pro-active by monitoring economic developments for new insights and researching investment options that may help you reach your goals. Even a simple act such as making an appointment to speak with your Relationship Manager or Personal Banker to review your portfolio may be a positive step towards staying informed of current economic changes.

“Make the decision to improve your financial situation through the things that you can influence rather than by simply reacting to external forces.”

Habit 2: “Begin with the End in Mind”

Ideally, before you even make a decision to invest, know what your goals are in terms of investment. In short, begin with the end in mind. Determine your short-term and long-term goals. Once you have a vision of how your investment portfolio should look like, you are more likely to find and evaluate investment instruments that fit into your plan.

Habit 3: Put First Things First

This habit is about making the main thing, the main thing. That means discovering your investment priorities and making decisions to put them first. You may choose to place greater emphasis on the things that are important to you. For instance, that could mean “paying yourself first” via contributions to your savings and retirement plan. Other priorities may be saving for your child’s education fund as time is of the essence in meeting this goal. An emergency fund, paying down debt and getting adequate insurance coverage are also priorities you may consider.

“Organise and execute your investments around priorities.”

Habit 4: Think Win-Win

Returns and risks are opposing sides of the coin. Investments that potentially yield higher returns may also leave you open to greater risk. On the other hand, safer financial options such as Fixed Deposits may offer modest returns. Having a win-win mindset is to realistically balance both risk and return: managing the risk level you are willing to take on with the best possible returns.

“Balance the best possible outcome from both sides.”

Habit 5: Seek First to Understand, Then to be Understood

Peter Lynch, famed investor and manager from Fidelity, offered the advice, “invest in what you know”2. When investing in stocks, take time to understand how the company generates income and profitability, read up on their main competitors and be familiar with the risks and opportunities in the field. The same concept applies to different types of investment instruments such as bonds, structured investments and unit trust funds.

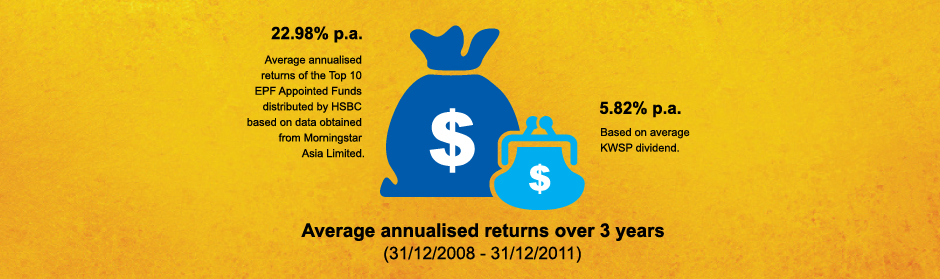

Understanding industry changes may open you to new investment opportunities. For example, the Employees’ Provident Fund (EPF) now has more stringent fund selection criteria in its Members Investment Scheme (EPF-MIS). Appointed Funds offered under the EPF-MIS must have a track record of at least 3 years and not more than 30% foreign exposure3. You may consider the EPF-MIS as an investment option to potentially grow your EPF funds at a faster rate. It also has lower upfront fees capped at 3% compared to the unit trust industry rate of 5% – 7%4. You may also consider withdrawing from your EPF savings to invest in appointed Unit Trust Funds every quarter (subject to a maximum of 20% from your savings in excess of the Basic Savings amount in your Account I).

Once you understand how investment works, set your investment ground rules and investment philosophy. They will serve as a compass especially when the market gets choppy. For example, some ground rules may include instructions on how often you wish to invest, your policy on speculation and your strategies on when to diversify or exit an investment.

“Invest in what you know.”

The diagram below shows the average annualised returns of the Top 10 EPF Appointed Funds distributed by HSBC and the average KWSP dividend over 3 years.

Habit 6: Synergise

There’s a famous saying that goes, “Two heads are better than one.” Take the opportunity to leverage on the skills and knowledge of those around you. Have a chat with your Relationship Manager for the latest investment news and opportunities. Put into good use any investment tool available such as the newly introduced HSBC’s Fund Navigator that places comprehensive fund analysis at your fingertips.

“Leverage on the strength of others.”

.

Habit 7: Sharpen the Saw

Stay updated and keep abreast of economic developments. The portfolio you set in place a few years ago may be outdated and not performing optimally. Regular portfolio rebalancing can realign your investments to your desired asset allocation that may have fluctuated over time. Your portfolio may also need to be reviewed as your life situation changes. You may also consider to periodically reflect on underperforming and successful investments with the aim of getting better results the next time round.

“Stay fresh. Stay keen. And do it all over again.”

If you make it a habit to develop these 7 habits, you may soon develop an investment discipline that may increase your effectiveness in making sound investments. That would be a great habit to have!

Source:

1. www.stephencovey.com/7habits/

2. USNews-Money, “Why You Need to Invest In What You Know”, 26 October 2010

3. The Star. “EPF members can buy unit trust with up to 30% foreign portfolio from August”, 4 June 2010

4. The Star, “High fees dampener for unit trust”, Saturday 12 November 2011

March 2012

LIKE THIS ARTICLE?

LIKE THIS ARTICLE?