Inflation

It doesn’t have to be ugly

Redesign your household budget to face inflation

“Inflation is when you pay fifteen dollars for the ten dollars haircut you used to get for five dollars when you had hair.”- Sam Ewing

Ready or not, inflation is everywhere. Malaysia’s inflation rate was at 3.5%, year-on-year, in June 20111. With the 7% hike in electricity tariffs from 1 June 2011 and further subsidy rationalisation planned for the second half of the year, inflation may continue to pick up2.

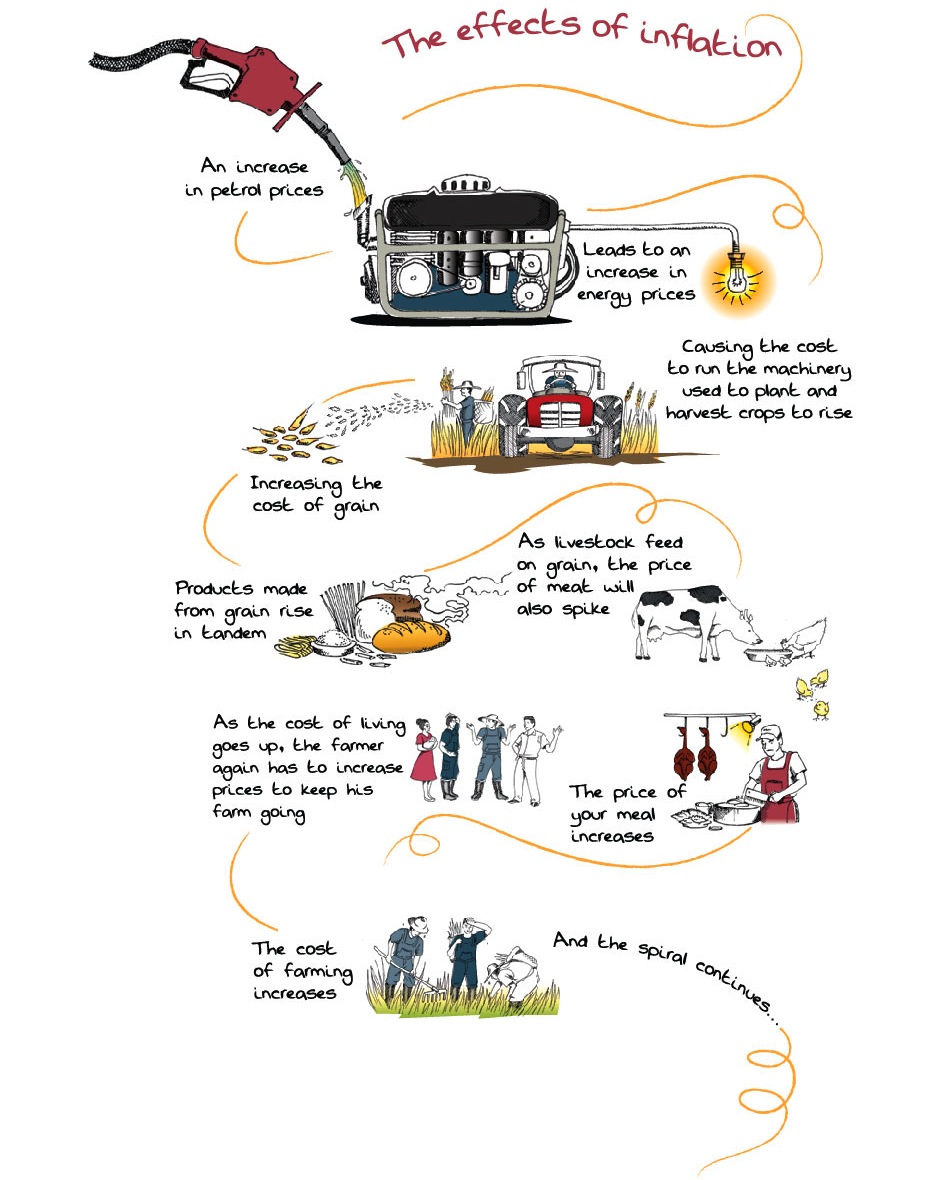

The effects could be further aggravated if the price of petrol continues to climb. Petrol prices are closely watched around the world as they have the ability to trigger a spiral of rising prices. For example, if petrol supply is limited and demand is high, petrol prices may rise and may set off inflationary pressures that may have a dramatic effect on consumers, and this may even increase the price of meat and rice in your grocery cart. As illustrated, petrol and food are interlinked.  Nevertheless inflation need not be feared. Rather, it has to be managed. As inflation erodes the value of the ringgit and shrinks your buying power, you can consider these two ways to handle it: reduce spending and/or increase your income in order to maintain your current lifestyle. Tightening your belt need not be an ugly affair. Instead consider giving your household budget a quick redesign and you may just thrive in this economic season. Check out our Household Budget Redesign Tips for a few ideas on where to add and subtract.

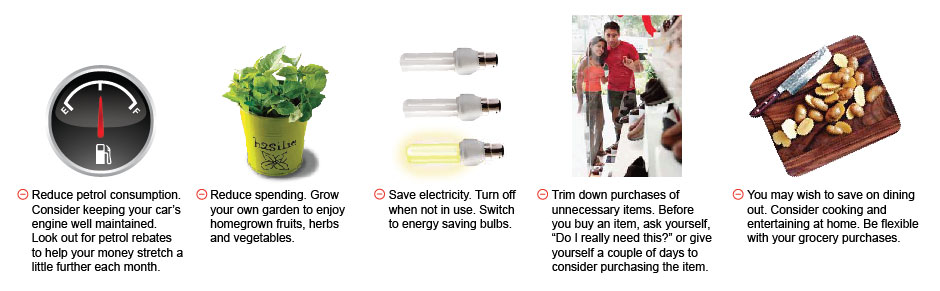

Nevertheless inflation need not be feared. Rather, it has to be managed. As inflation erodes the value of the ringgit and shrinks your buying power, you can consider these two ways to handle it: reduce spending and/or increase your income in order to maintain your current lifestyle. Tightening your belt need not be an ugly affair. Instead consider giving your household budget a quick redesign and you may just thrive in this economic season. Check out our Household Budget Redesign Tips for a few ideas on where to add and subtract.

Household Budget Redesign Tips: Great living at a great value

Reduce spending:

Key principles

Pay off the big ticket items first, for instance, your home loan. Consider looking for a flexible home loan that allows you to make extra payments whenever possible. Even a small amount of an additional RM300 a month can make a big difference in reducing the amount of interest paid, irrespective of whether inflation is on the rise or not. It could save you on interest and allow you to continue enjoying other priorities in life. Don’t overbuy on what you need. You may need a TV but a 55” LED 3D TV has to be considered carefully as you may over commit your finances. Be smart with discretionary spending.

Increase income:

Invest in yourself

Pay yourself first. You may wish to set aside a percentage of your monthly income into your savings, retirement fund, children’s education fund and investments. Increase cash flow. Consider investments that provide returns at higher than inflation rates. Selected income funds and stocks from companies that do well during inflation may provide you with income from dividends based on the companies’ performance and earnings. Consider how to increase your income streams and perhaps even start a business. Build up a contingency fund. It may be in money terms (funds that are available to be re-directed in case of unforeseen expenses) or in lifestyle terms (certain categories of spending where you can cut if necessary)3.

Making it happen with HSBC

Own your home in half the time1

One possible way to reduce your home loan interest is to deposit your salary and bonuses into a flexible home loan account such as our HomeSmart-i. Withdraw the excess payment via the ATM when you need to for your expenses. The longer the money stays in your account, the harder it works to pay off your home loan as interest is calculated on a daily basis based on your current outstanding balance. So by retaining more money in your account, your current outstanding balance and interest is reduced as well.

Save for your child’s bright future

The Takaful Education Plan2 is an investment-linked Takaful plan that may offer you potentially higher returns3 as compared to deposit accounts. Not only will you receive a payout4 when your child reaches university age, you and your child will also receive Takaful protection.

Spend and get Cash Back

Consider applying for a credit card that gives you privileges for your everyday lifestyle.The HSBC Amanah MPower Visa Platinum Credit Card-i offers a Cash Back5 of up to 8% on your dining, petrol and groceries purchases.

Shop smart

Always check for offers and promotions on the items that you would like to buy, places you would like to dine in or hotels you wish to stay in. HSBC SmartPrivileges and Home&Away6 deals feature fantastic deals from merchants locally and around the world.

1. This is dependent on fulfilment of certain conditions, namely the financing amount granted and its tenure, monthly income and savings and/or idle funds that can be maintained by the individual(s) in the HomeSmart-i account. This is not an offer of credit. All applications are subject to our Terms & Conditions and credit evaluation.

2. Takaful Education Plan is managed by HSBC Amanah Takaful (Malaysia) Sdn. Bhd. (Company No. 731530-M). HSBC and HSBC Amanah are the distributors for this plan. Terms & Conditions apply.

3. The investment returns will fluctuate (i.e. rise or fall) based on actual performance of the investment-linked funds.

4. The payout amount depends on the performance of the funds selected and is not guaranteed. The regular payout option is only available if a covered person‘s (child’s) entry age is from 1 month to 12 years.

5. Amended MPower Visa Platinum 8% Cash Back Programme 2013 Terms and Conditions apply from 1 March 2013 – 31 December 2013. 5% Cash Back for Total Monthly Spend of RM2,000 and below or 8% Cash Back for Total Monthly Spend of RM2,001 and above. Cash Back on Petrol, Groceries and Dining is only applicable for Petrol, Groceries and Dining spend made during weekends i.e. Saturdays and Sundays during the Programme Period. The maximum Cash Back on Petrol, Groceries and Dining for Each Eligible Cardholder(s) is RM100 per participating month. Participating merchants nationwide: Petrol – Shell, Caltex and Petronas. Groceries – Giant, Tesco and AEON Big. Dining – Any spend that are made at local merchants categorized as Dining in the Merchant Category Codes. For the full terms and conditions, visit www.hsbcamanah.com.my/MPlat.

6. Home&Away privilege programme offers all the HSBC credit cardholders with an array of fabulous privileges around the world, with over 19,000 outlets in more than 160 countries and territories. No matter you are staying at your home or travelling, do not miss out any advantages that we have prepared for you. Please visit www.hsbc.com.my for more details.

Stocking your investment cabinet

In times of inflation, the key investment principle to remember is to protect your wealth from being depleted due to inflation. Some investment instruments may do better during inflation than others, so a diversified portfolio may serve you better during such times. Let’s take a look at some investment options and the effect of inflation on them.

.

Real Estate Investment Trust (REIT)

With REIT, you get to enjoy the benefits of investing indirectly in property. REIT is a trust fund that holds/invests in real assets like office buildings, malls, warehouses that generate rental income which is paid to the investor as dividends. REIT is becoming an increasingly attractive option for property investment with its lower entry cost4 and average dividend yield as high as 8% p.a.5. There are currently 14 REITs listed on Bursa Malaysia5 and their prices can be monitored via the newspaper or online trading platforms. Dividend from REITs are subject to 10% withholding tax for resident and non-resident individuals6.

Property

Property in good locations may be a good hedge against inflation over the long run as the rise in the value of the property may exceed the inflation rate. If affordability is not a question, a flexible home loan can help you pay up your loan as fast as possible.

Commodities

Commodities like gold may aid in diversifying the risk element in your portfolio. The World Gold Council writes, “Investors around the world recognise gold as one of the most reliable hedges against inflation. The value of gold, in terms of the real goods and services it can buy, has remained largely stable for decades, if not centuries7”. Of course, gold is not the only asset to zoom in on. Other precious metals, the energy sector and agribusiness are also options to consider.

High Yield Bonds

Besides providing a platform to diversify your portfolio, high yield bonds have typically performed well during the period of economic expansion. “The reason is that corporate earnings are boosted when the economy is on its upward momentum. The improvement in earnings and balance sheets would drive down the default rates and lead the rating agencies to upgrade the credit ratings,” states Fundsupermart.com8.

Equities

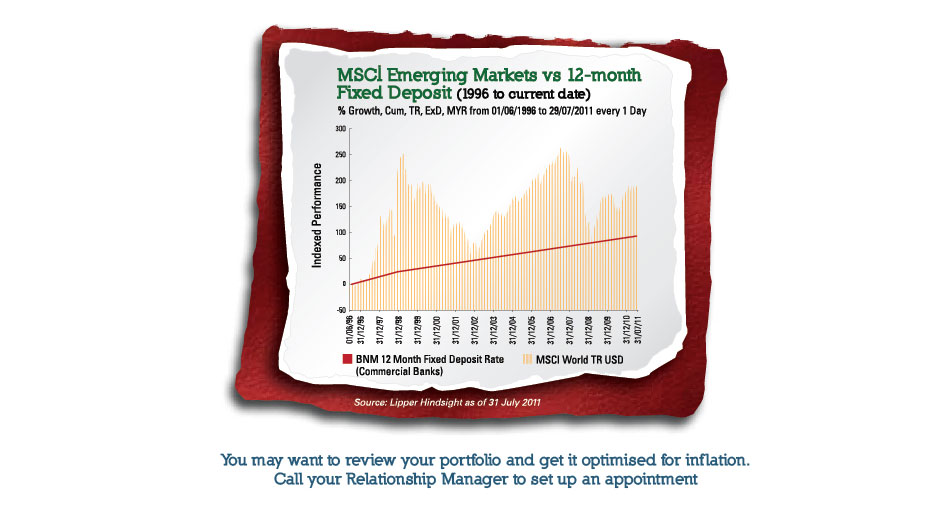

Do not dismiss stocks during times of inflation. However, the key is to choose the right stocks and perhaps aim to hold them for a longer term. Look for markets and companies that may benefit from inflation, e.g. selected equities from Emerging Markets and companies involved in commodities. These companies may see a rise in income as commodities prices rise during inflation. The chart below plots the growth trend of the Morgan Stanley Capital International Emerging Market (MSCI EM) indices versus returns from Fixed Deposits9. Over the long run, equities may offer returns that outpace the inflation rate.

Source: 1. The Department of Statistics Malaysia 2. The Star, “Inflation is still a concern” 24 May 2011 3. www.wisebread.com “Budgeting in a time of inflation” 23 April 2008 4. The Star, “Why REITs should be the choice of investment”19 July 2010 5. The Star Property, “REIT vs direct real estate investment” 7 August 2010 6. The Star Property, “REIT managers seek waiver of withholding tax” 15 October 2010 7. World Gold Council, “Inflation hedge” published on its website www.gold.org 8. Fundsupermart.com, “High Yield Bonds May Beat Inflation” 24 May 2011 9. Lipper Hindsight, 31 July 2011

LIKE THIS ARTICLE?

LIKE THIS ARTICLE?