Turn the constant uncertainty of interest rate changes

into potential financial opportunities.

Watch the news and you will hear talk of a possible reduction of the Overnight Policy Rate (OPR) by Bank Negara Malaysia or the possibility of the US Federal Reserve raising interest rates soon. Open a time deposit account and you will receive interest on your deposit. Take a home loan and you will have to pay interest on your loan.

Interest rates are intricately tied to our everyday lives and can affect us in many ways – from our savings to our loans and even our investments over the longer term. They are part and parcel of living in a world that relies heavily on credit and debt. Without the ability to borrow money, you probably would not be able to buy a house or a car, or even finance your business and do many other things that requires credit.

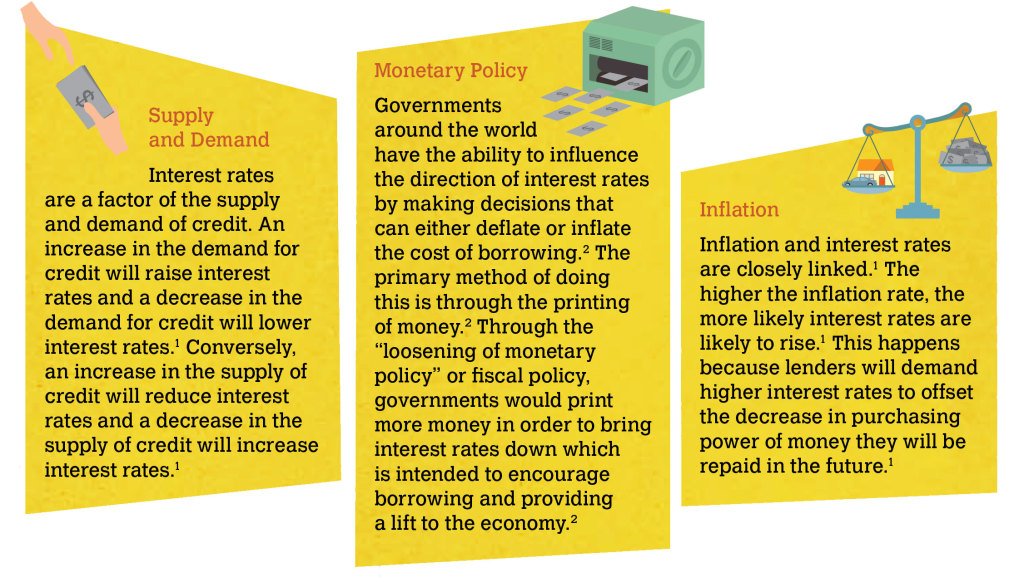

THE FORCES BEHIND INTEREST RATES

An interest rate is essentially the cost of borrowing money.1 Seen differently, it is the compensation to the lender for the service and risk of lending money.1 Without interest rates, financial institutions would not be willing to lend and people may not save their money.1

So why do interest rates rise and fall? And what causes interest rates to change? Here are the three main factors:

Changing Interest Rates and You

Our economy is a living, breathing, interconnected system and interest rates play a big role within it.3 When a country’s central bank – like the US Federal Reserve or Bank Negara Malaysia – decides to change the interest rates, these changes get passed on to the rest of the economy.3

Often, central banks will use interest rates as a means to manage the economy of a country. For example, central banks generally seek to target low inflation.4 If a central bank forecasts inflation to rise above a set target, it would increase interest rates to moderate economic growth and reduce the inflation rate.4 On the other hand, if a central bank forecasts inflation to fall below the target, it would cut interest rates to boost consumer spending and economic growth.4

When central banks change the interest rates at which banks borrow money, these changes are then passed on to the rest of the economy.3 Since the global financial crisis in 2008, interest rates globally have been kept at relatively low levels to keep economies moving forward. By keeping interest rates low, banks can borrow money for less.3 In turn, banks can then lower interest rates they charge to individual borrowers, making loans more attractive and competitive.3 If you were thinking about buying a home or a car, lower interest rates may spur you on to take loans and spend.3 And the more consumers spend, the better the economy performs and grows.3

When the US Federal Reserve lowers or hints at lowering interest rates, the stock market will typically trend upwards because it is a sign to investors that people will be buying more goods and services, and that companies will ramp up production and create more jobs.3 Lower interest rates also make the stock market more attractive because of the lower returns on other investments such as savings, bonds and fixed-rate securities.3

On the flip side, central banks could also decide to increase interest rates if they are worried inflation is likely to increase, in an effort to reduce demand and reduce the rate of economic growth.

US up, Malaysia down: What if?

There have been headwinds that the US Federal Reserve will resume tightening its monetary policy after the first rate hike of 25 basis points in December 2015 – the first since 2006.6 However, HSBC Global Research expects the US economy to remain soft for the rest of 2016 and two 25 basis point hike in 2017.7 In the meantime, HSBC Global Research believes Bank Negara Malaysia will likely make a 25 basis point cut in 1Q 2017.8

According Dr Irwan Shah Zainal Abidin, Senior Lecturer at the School of Economics, Finance and Banking, University Utara Malaysia, while a US Federal Reserve decision to increase rates would have some impact to the dynamics of emerging economies like Malaysia, the direct impact would be minimal because the move has been highly predicted by market players.6

Dr Irwan says in the short term, capital will leave Malaysia looking for a safe haven and better returns, and would consequently lead to a stronger US Dollar. This will dampen the performance of the Ringgit.6 Fortunately, the recent rebound in crude oil prices appears to provide a buffer and has offset the downward trend of the Ringgit in the aftermath of the rates hike in the US.6

Dr Irwan also commented that Malaysian economic fundamentals seem relatively strong which will provide better resilience to weather possible negative impacts due to interest rates increase for 2016.6

For investors who are comfortable holding either the Ringgit or US Dollar, the fluctuations of the Ringgit versus the US Dollar may offer opportunities in foreign exchange investment products. For example, HSBC’s Dual Currency Investment may offer potentially higher returns through investing in a currency-linked option with the possible currency movements of the Ringgit and US Dollar. Other products like Foreign Currency Savings Account or Time Deposits may be suitable to save for future needs. There is the potential for the US Dollar to rise if the US Federal Reserve decides to hike interest rates.13

Meanwhile, if Bank Negara Malaysia decides to cut the country’s OPR to head off a potentially slowing domestic economy and protect Malaysia from external risks, there will be knock-on effects for Malaysians.9 One of the most obvious benefits of a lower interest rate is the lower interest on loans.10 If banks choose to pass on the interest rate cut, you will pay less interest on your mortgage, personal, business and hire purchase loans.10 This means it will be cheaper for eligible consumers and companies to take advantage of loans like HSBC’s home loans and business premises financing.

Rate cuts in Malaysia may also bode well for Real Estate Investment Trusts (REITs). Typically, REITs, which offer healthy dividends fuelled by rental income, tend to gain from monetary easing due to their relatively stable and high yield nature compared to other assets such as bonds and short-term bills.11 Lower interest rates may also help boost earnings by reducing a REIT’s interest expense on borrowings.11

Another potential benefactor of a low interest rate environment in Malaysia could be the stock market as mentioned earlier. With interest earnings reduced from savings and fixed deposits due to a reduction in the OPR, it may be worthwhile shifting savings to investing in the stock market. For investors who may not be comfortable investing directly in the stock market, another option would be unit trusts which have strong exposure to the stock market. If the stock market rises, then unit trusts with strong portfolios in equities could benefit from the stock market’s performance.

After the announcement of the first OPR cut in July 2016 by Bank Negara Malaysia, the Malaysian Ringgit showed improvement against numerous major currencies including the US Dollar, Singapore Dollar, Japanese Yen and British Pound.9 Another OPR cut may help strengthen the Ringgit again.9 If you have foreign currency needs, it may be beneficial to take advantage of the possible strengthening of the Ringgit if Bank Negara Malaysia lowers the OPR again.

Bonds are another area to leverage on with falling interest rates supporting corporate and financial issuers who have seized the opportunity to enjoy lower funding costs. Malaysian bonds have also seen strong demand from both local and international investors who have been scouring the global markets for higher yield assets.

When new bonds are issued, they typically carry coupon rates or yield at or close to prevailing market interest rates.14 Bond prices and interest rates have an inverse relationship; when one goes up, the other goes down.14 Investors constantly compare the return on their investment, so as interest rates change, a bond’s coupon rate becomes more or less attractive to investors, who are therefore willing to pay more or less for the bond.14 If interest rates drop below the original coupon rate for a bond, the bond would be worth more.14 It would be priced at a premium since it would be carrying a higher interest rate compared to what is currently available on the market.14 Of course, the reverse would happen if interest rates rise.14

As such, there may be opportunities in the Malaysian bond market if Bank Negara Malaysia lowers interest rates again.

To find out more about how you could take advantage of the current situation, speak to your Relationship Manager or walk into any HSBC branch today.

• Sources: 1 Investopedia.com, Forces Behind Interest Rates, undated. 2 The American Monetary Association.org, 3 Reasons Interest Rates Change, undated. 3 How Stuff Works.com, How Interest Rates Work, undated. 4 Economics.help, Factors Affecting Interest Rates, May 10, 2011. 5 Economics.help, Effect of Raising Interest Rates, undated. 6 New Straits Times Online, The Impact of Fed Hike on Malaysia, June 21, 2016. 7 HSBC Global Research, FOMC Multi-Asset Reaction: Split the Balance, September 21, 2016. 8 HSBC Global Research, Malaysia Central Bank Watch: Postponing Our Rate Cut View, November 17, 2016. 9 Propertyguru.com.my, 6 Impacts of the Overnight Policy Rate Reduction, July 18, 2016. 10 Comparehero.my, How Will the OPR Cuts by Bank Negara Benefit Malaysians?, July 22, 2016. 11 Nikkei Asian Review, Malaysia’s Recent rate Cut Renews Appeal for REITs, July 19, 2016. 12 The Star Online, Bond Market Staying Its Course in Malaysia, October 1, 2016. 13 Investopedia.com, How the Fed Fund Rate Hikes Affect the US Dollar, 12 October 2015. 14 Wells Fargo Asset Management, The Relationship Between Bonds and Interest Rates, undated.

LIKE THIS ARTICLE?

LIKE THIS ARTICLE?