Retirement:

Have you thought about it lately?

Try as one may, time cannot be stopped or even delayed. We spend most of our younger years building a career and earning a living. Before we know it, we may be given the proverbial golden watch as a token reminder of our working years. For many, retirement is a new lease of life. No longer bound by the constraints of work, we are free to pursue new goals and enjoy a more leisurely life.

For some though, retirement and its subsequent loss of income can be worrying. In the “Future of Retirement” survey by HSBC1, respondents from the age group of 40 – 79 were asked what their main fears concerning retirement were. Over 78% voiced the fear of illness and disability, while the fear of not having enough money came in a close second at 70%.

Only 34% of Malaysians save for retirement

Despite the fear of insufficient income to fund you later in life, what is alarming is that a majority of Malaysians are not putting retirement savings plans into action.The Star newspaper reports that only 34% of Malaysians are putting aside money regularly for their retirement funds besides their EPF contributions.2

While the reasons may be varied as to why people remain uncertain about retirement planning, one factor could be the lack of access to financial advice and financial education which could lead to a failure to identify appropriate solutions to financial needs.3 In Malaysia, a staggering 73% of respondents surveyed failed to seek advice from financial professionals, a behaviour that compounds Malaysians’ poor retirement planning ability further.2

By not seeking professional advice, many products along the savings life cycle may be overlooked or may not be considered as a potential source of retirement income.

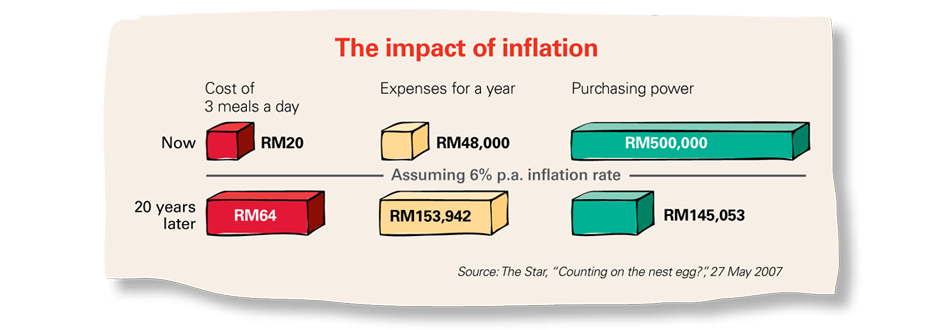

Inflation, the enemy of your retirement

So what if you are already setting aside a sum of money for retirement, what factors should you take into consideration? Some of the most important factors which must be taken into account are inflation and the rising cost of living in the future.

Both factors can drastically reduce the value of your savings. For example if a person’s desired retirement income is RM120,000 p.a. at current value, he will need to save a lot more after considering inflation. Let’s assume the inflation rate for the next 24 years before he reaches retirement age is 5% p.a. After adjusting for this inflation rate, he would need to have an annual income of RM387,011 to continue with his current lifestyle when he retires in 24 years time. As a result, unless the returns from his investment portfolio exceeds inflation and the cost of living, his retirement income will be quickly exhausted.4

Is EPF savings enough?

Your EPF savings is a basic retirement plan with low risk. For the financial year ended Dec 31, 2009, the EPF board declared a dividend of 5.65%, up 115 basis points over the 4.5% paid for 2008. Nevertheless, when inflation is taken into account, the return rate may not be as attractive. “According to Fundsupermart.com Malaysia, over the past five years, EPF has been distributing an average annual dividend of 5%. The average real dividend rate for the past five years was 1.7%, after reflecting an average inflation rate of 3.4%,” reports The Star.5

Another risk associated with EPF savings is the tendency to withdraw the entire sum and use it all up quickly. It has been reported that 70% of contributors who withdraw their entire EPF savings at age 55 deplete all their EPF savings in just three years post-retirement.6 Opting to withdraw your EPF Savings with the Flexible Age 55 Withdrawal scheme, where savings are released on a periodical basis instead of a lump sum, is a better move to guarantee consistent income in your retirement years.

When do you start planning for retirement?

The quality for your retirement however, largely depends on what you set in place while you are still earning an income. Along with your other investment and savings goals, clarify your retirement goals. Then set aside a certain percentage of your income for it. Match your goals to appropriate investment vehicles. Do take into consideration risks and returns as well as your personal risk appetite. Some investments which you may want to consider include fixed income investments (e.g. bonds, bond funds), structured investments, Takaful Investment Plan and property. Adjust your plan as your income and goals change along the way.

Start as soon as you can

Talk to your Relationship Manager as soon as possible regarding the investment of your choice. Don’t delay as time and the power of compounded interest can work to your advantage by providing a much larger end sum at retirement age. If possible, set up a regular investment or savings scheme to ensure you work towards achieving your goals. Periodically, review your portfolio to ensure that your plans are still effective in hitting your targets. Then, look forward to your golden years with confidence knowing that your later years are provided for.

Source:

1. The Future of Retirement III, Malaysia Report.

2. The Star, “Planning for retirement”, April 4, 2009.

3. The Future of Retirement 2009: It’s time to prepare.

4. Securities Industry Development Corporation, Malaysian Investor, “Saving for your Retirement, Part 1”.

5. The Star, “Are EPF savings alone enough?”, March 13, 2010.

6. The Star, “Saving early for retirement”, June 21, 2009.

LIKE THIS ARTICLE?

LIKE THIS ARTICLE?