At the age of 33,

every young

working adult feels almost invincible.

Well, almost.

You’re feeling on top of the world. Why shouldn’t you? You’re at an age where you can choose how to spend your money, buy most of what you want and live life however you please.

You may have already purchased your dream car, your dream house and you recently married the girl of your dreams and… you just came back from your honeymoon in Bali.

When you feel like hanging out with your friends, you can choose to hang out at the latest cafes, catch the latest movies in town and dining would usually take place at restaurants with the best food to offer. Planning for vacation is the norm because you tell yourself what is life if you can’t even enjoy it!

You feel good because at this moment, nothing can go wrong with your life. You’re still young and you have so many glorious years a head of you. You have definitely earned the right to enjoy the money you made. So your tell yourself ‘Enjoy first, save later’. Little that you know your ‘later’ could be too late.

.

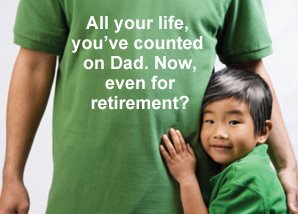

Be young and smart

This is a familiar situation. In the light of more pressing commitments, saving for retirement is often relegated to the lowest rung of priorities. And you’re not alone. In a survey, more than half of Malaysian workers have not prepared for retirement while those who have, only started planning after age 40.1

While it is better late than never, starting early can make a huge difference to your retirement fund. Here is a fictional case study that shows how two fresh graduates, who made different financial decisions, went through their lives.

.

Your secret weapon: Compound Interest

Mark and Simon both graduated from university at the age of 22 and both started their careers earning RM40,000 a year. Mark understood the important of saving early so he started investing RM250 per month towards a retirement plan that could potentially earns a 5% rate of return as soon as he landed his first job. Eleven years later, Mark terminated his retirement contributions because he had already build up an accumulated total of RM78,501.89. This nest egg would be good enough to grow to at least RM400,000 during retirement age. The extra RM250 would now be channeled to helped him achieved his other plans such as saving for a down payment for a house, non-retirement savings, or educational funds for the kids.

On the other hand, Simon, unaware of the value of time, procrastinated saving towards his retirement until ten years later. He then started saving RM250 per month as well but he would need to continue doing this until he retired to catch up on his goal.

What a difference in their accumulated total nest egg! Mark contributed only RM33,000 but he had RM387,532.06 in total at age 65 while Simon, who contributed an additional RM66,000, had only RM251,349.65. This scenario shows you why you should start saving for retirement as early as you can. The more time you have, the less money you need to contribute to maintain the same accumulated amount (assuming that the rate of return is the same throughout).

The principle remains: Pay yourself first. Just this one step of setting aside a sum of money towards your retirement the moment you get your first paycheck can make all the difference. By planning well in advance, your can ensure that you meet retirement with confidence and enjoy it to the very fullest.

A fulfilling retirement begins with one small step today. Talk to our Relationship Managers on HSBC Advance to find out about HSBC’s new retirement plan.

Call 1 300 88 0181, visit your nearest HSBC branch for more information or visit www.hsbcadvance.com.my to register online.

Facts that figure

- 90% of EPF contributors have less than RM100,000 in their accounts.2

- 83% used their retirement savings when the need arose before reaching retirement.3

- 39% intend to work beyond retirement age to supplement their income.3

Source:

1. The Star, “Majority neglect retirement plans” March 14, 2008.

2. The Star, “Most Malaysians do not have financial security” May 27, 2007.

3. The Star, “Planning for Retirement” April 4, 2009.

LIKE THIS ARTICLE?

LIKE THIS ARTICLE?