An overseas education is a costly financial commitment and foreign exchange volatility could potentially add to the cost of funding your children’s university tuition fees and living expenses abroad. Foreign exchange rates rise and fall constantly. So if the Malaysian Ringgit were to weaken against the currency of the study destination your children have chosen i.e. AUD, GBP or USD, the cost of their tuition fees and living expenses will become more expensive in Ringgit terms.13

Planning Ahead

So where do you start? If you have decided where to send your children to further their university education, then you could start saving or investing in the study destination’s currency to cushion the impact of potential currency fluctuations. For example, if you have decided to send your children to study in Australia, you could look at hedging the Ringgit against the Australian Dollar. Forex hedging is a strategy to protect an existing or anticipated position from an unwanted move in exchange rates to minimise future downside risk.15 It is worthwhile to note that hedging is not a money making strategy.15

Choosing a Currency to Protect Against Fluctuations

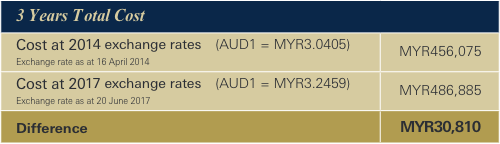

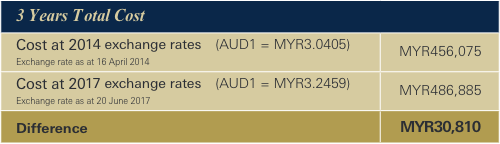

Let’s use the scenario of pursuing a three-year undergraduate degree based on an annual cost of AUD50,000 in Australia using historical exchange rates as an example. So back in 2014, you made the decision to send your children to Australia to start their undergraduate degree in 2017. In 2014, the exchange rate from Ringgit to the Australian Dollar was RM3.0405 to AUD1.14 Three years later, in 2017, the Ringgit had depreciated against the Australian Dollar with an exchange rate of RM3.2459 to AUD1.14

Due to the rise of the AUD, you would have had to pay RM30,810 more to cover the cost of your children’s education in Australia over that period because of currency fluctuations.

Exchange rates are obtained from www.xe.com, as at 7 May 2018. Past performance is not indicative of future performance.

Protect Against Currency Fluctuations

Some possible strategies to use for hedging your Ringgit include dual currency investments, buying and holding foreign currency denominated bonds, investing overseas and investing in stocks that may benefit from Ringgit volatility.16

For example, if you are planning to send your children to the UK in the next couple of years, you could put money into HSBC’s Dual Currency Investment17 with a currency pairing of MYR and GBP or hedge against any GBP fluctuations by opening a GBP denominated Foreign Currency Time Deposit account.

If you have a longer time horizon to plan for your children’s overseas education, you could also consider investing in HSBC’s foreign currency unit trusts, bonds or perhaps invest in real estate abroad as a hedge against foreign currency movements.

Preparing for University

As a Premier customer, you can take advantage of our foreign currency services available to make your children’s transition overseas easier and more seamless. For example, you are able to open a bank account for your children overseas from Malaysia before they move abroad.

With Global View Global Transfers, you have the convenience of managing all your accounts in one place and transfer money instantly between your local and overseas HSBC accounts at no cost18. In addition, you can make convenient online transfers abroad via our Telegraphic Transfer with Real-Time FX rates to get competitive exchange rates.

To find out more about how we can help with managing your children’s higher education funds, speak to your Relationship Manager or walk into any HSBC branch today.