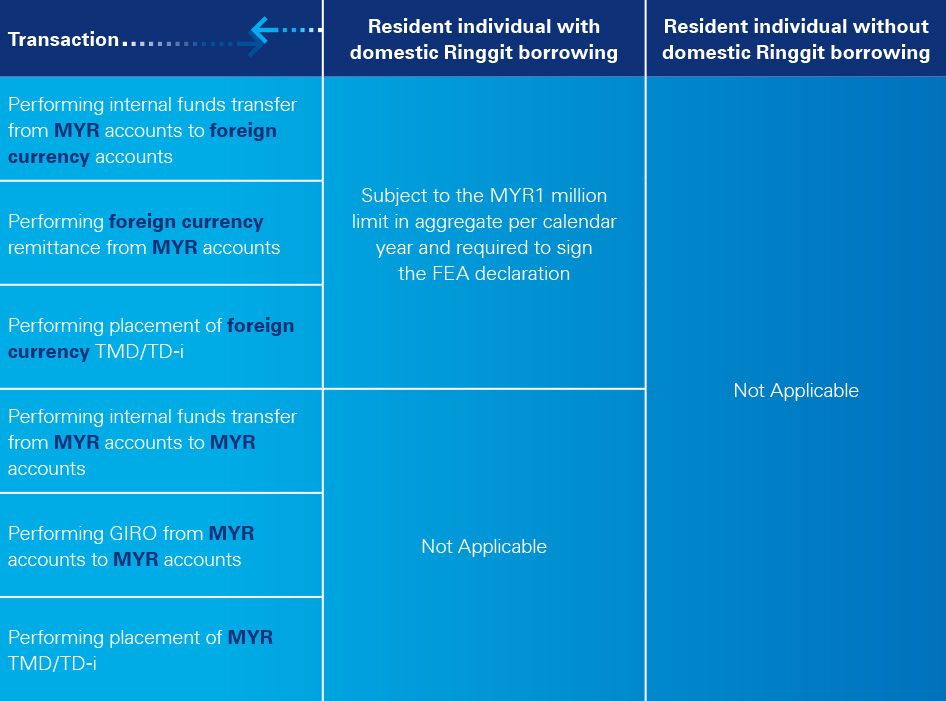

How do the new FEA Rules impact you?

Under BNM Notices on FEA Rules, resident2 individuals are allowed to undertake investment abroad1 and investment in foreign currency asset1 onshore of:

- Any amount using foreign currency funds –

- From abroad, other than proceeds from export of goods

- From a non-resident2, other than foreign currency borrowing

- up to RM10 million equivalent in aggregate using funds from foreign currency borrowing/financing obtained from a licensed onshore bank or a non-resident

- up to RM1 million equivalent3 in aggregate per calendar year using funds from –

- Conversion of Ringgit

- Swapping of financial assets

- Transfer from Trade FCA

BNM’s approval is required where the threshold is exceeded.

Funds for education and employment

The transfer of funds overseas for the purpose of education or employment are not subjected to the RM1 million limit per calendar year1. However, you will still need to visit a bank branch with supporting documents.

Sample supporting documents for education including:

- Letter of Acceptance from educational institution

- Notification Letter of semester payment/invoice

- Student ID

- Student Visa

Sample supporting documents for employment abroad (i.e. Malaysian working abroad):

- Company Offer Letter

- Working Permit

Definition of Investment Abroad1

- Purchase of foreign currency-denominated asset in Malaysia offered by a non-resident, including Labuan entity;

- Purchase of foreign currency-denominated asset offered outside Malaysia;

- Administrative expenses, working capital arising from the set-up of any business arrangement, including a joint-venture project where no entity is created or established, outside Malaysia;

- Purchase of foreign currency-denominated financial instrument or Islamic financial instrument without firm commitment, other than exchange rate derivative, offered on an overseas Specified Exchange under the Capital Markets and Services Act 2007 [Act 671] undertaken by a resident through a resident futures broker;

- Placement into foreign currency account overseas other than for education or employment abroad;

- Lending in foreign currency to non-resident; or

- Swapping of financial asset in Malaysia for financial asset outside Malaysia.

Definition of Resident2

- A citizen of Malaysia, excluding a citizen who has obtained permanent resident status in a country or a territory outside Malaysia and is residing outside Malaysia;

- A non-citizen of Malaysia who has obtained permanent resident status in Malaysia and is ordinarily residing in Malaysia;

- A body corporate incorporated or established, or registered with or approved by any authority, in Malaysia;

- An unincorporated body registered with or approved by any authority in Malaysia; or

- The Government or any State Government.

Definition of Non-Resident2

- Any person other than a resident;

- An overseas branch, a subsidiary, regional office, sales office or representative office of a resident company;

- Embassies, Consulates, High Commissions, supranational or international organisations; or

- A Malaysian citizen who has obtained permanent resident status of a country or territory outside Malaysia and is residing outside Malaysia.

Definition of Foreign Currency Asset Onshore1

- purchase of foreign currency-denominated security or Islamic security offered in Malaysia by a resident as approved by

the Bank; - purchase of foreign currency-denominated financial instrument or Islamic financial instrument offered in Malaysia by a resident as approved by the Bank; or

- placement into foreign currency account with a licensed onshore bank other than placement for investment abroad.

Definition on Domestic Ringgit Borrowing/Financing1

- Trade credit terms extended by a supplier for all types of good or services;

- Forward contract with a licensed onshore bank excluding a contract that involves the exchanging or swapping of Ringgit or foreign currency debt obligation with another foreign currency debt obligation or the exchanging or swapping of foreign currency debt obligation with a Ringgit debt obligation;

- Performance guarantee or financial guarantee;

- Operational leasing facility;

- Factoring facility without recourse;

- A credit facility or financing facility obtained by a resident individual from a resident to purchase one residential property and one vehicle;

- Credit card and charge card facility obtained by a resident individual from a resident.

Frequently Asked Questions

2. Who is affected by this?

3. What is expected of customers?

4. When does this take effect?

5. What are the affected products?

6. What is the definition of calendar year? When will the RM1 million limit be refreshed?