Dollar Cost Averaging: A Smart Investment Strategy Amidst Market Volatility

2015 has been an up and down year for the Malaysian market. Particularly in the second half of the year, market sentiment has been down because of the continued weakening of the Ringgit.

The Kuala Lumpur Stock Exchange has not been spared either. In August 2015, the KLSE Composite Index lost 7.18% in tandem with the Ringgit plunge.1 Fortunately, the KLSE has clawed back some of its losses since its 52-week low on 25 August 2015.1

According to Securities Commission chairman Datuk Ranjit Ajit Singh, investors' confidence in the Malaysian capital market continues to hold with sentiment expected to pick up despite the weakening of the Ringgit.2 He added that continued market confidence is demonstrated by the fact that Malaysia has a net sales position in mutual funds.2

Investors' confidence in the Malaysian capital market continues to hold with sentiment expected to pick up despite the weakening of the Ringgit.2

“People recognise that the market and economic fundamentals of Malaysia are strong. Most fund managers do acknowledge that Malaysia has built strong financial and capital market systems. Markets are prone to adjusting but they'll correct themselves and markets will pick up again,” Ranjit told reporters at the World Capital Markets Symposium 2015 in Kuala Lumpur recently.2

So what should an investor do?

Do you hold on to your hard-earned cash and wait for the storm to blow over? Or do you instead continue to invest in the market and hope for the best?

Typically, investors have three major concerns when investing: making a profit on their investment, minimising risk and the prospective rate of returns they will likely receive.3 Most of us prefer investment which provides the highest returns in the shortest time possible – with minimal risk involved. In reality, we are not Warren Buffett so we have to invest sensibly using strategies that match our financial resources and investment skill level.

Dollar cost averaging also reduces the risk of investing a large amount in a single investment at the wrong time.

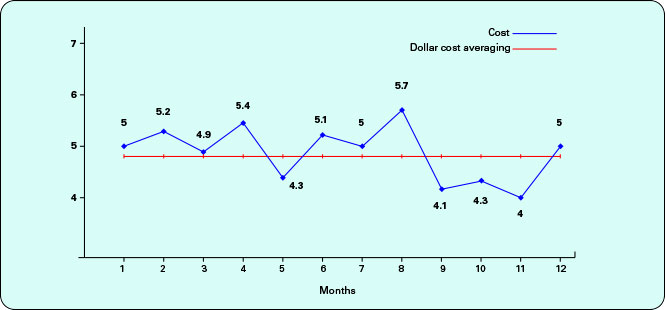

This is where the strategy of dollar cost averaging comes in. In simple terms, dollar cost averaging is a technique of buying a fixed dollar amount of a particular investment on a regular basis, regardless of the securities price.4 Most securities are purchased when their prices are low and fewer stocks are bought when their prices are high.4

In the long term, the average cost per share of the stock is less significant.4 Dollar cost averaging also reduces the risk of investing a large amount in a single investment at the wrong time.4

Is dollar cost averaging for you?

Generally, dollar cost averaging is a strategy that is better suited for investors with a lower appetite for risk and a longer-term investment view.5 This strategy makes the most sense when utilized over a long period of time with volatile investments like stocks and mutual funds.5

While dollar cost averaging may reduce your risk, this strategy is no guarantee for good returns on your investment.5 You will still need to conduct your own due diligence on securities or mutual funds which you have decided to invest in.5 Plus, you should regularly check on how your investments are performing.

Implementing the dollar cost averaging strategy3

1. Determine how much you can realistically afford to invest over an extended period of time

This is important because the strategy will not reduce your risk of loss effectively unless the investment amount is consistent over an extended period of time. If you make a large initial investment followed by increasingly smaller amounts, you will not insulate yourself against losses as effectively. In such a scenario, the gap between the average stock price and current market value will be larger and the risk for loss greater.

2. Choose your investments carefully

You will need to stay with this investment for many years for the strategy to be effective so choosing how to diversify your investments and reducing your risk by investing in mutual funds may be a prudent approach.

3. Pick an investment interval you can stick with over the long-term

Whether it's monthly, bi-monthly or even quarterly, choose how often you are going to invest a portion of your earnings and commit to it. Longer intervals are better because they can potentially reduce multiple transaction fees and also allow you to buy more stocks with each investment.

The bottom line is that dollar cost averaging may potentially help you reduce market risk while building your investments over time. If you need more information on dollar cost averaging, please feel free to talk to your Relationship Manager or walk into any HSBC Bank branch.

(1.)Financial Times.com, World Indices: KL Composite Index, 10 September 2015. (2.)The Sun Daily, SC: Confidence in the Market Still Strong, 4 September 2015. (3.) Investor Guide.com, The Basics of Dollar Cost Averaging Stock Strategy. (4.)Investopedia.com, Dollar-Cost Averaging. (5.) NASDAQ.com, Why Dollar Cost Averaging is a Smart Investment Strategy, 19 May 2014.

LIKE THIS ARTICLE

LIKE THIS ARTICLE