Will Leaving The Workforce

Work Out Financially For You?

Women are known to have multiple roles as homemakers, career professionals, social leaders, community participants and many other responsibilities. Put them all together and you'll find they do an amazing lot in life. They are so often daughter, wife, mother, teacher, driver, carer, worker, cook, home engineer - the list seems endless!

Working at home or working at a job?

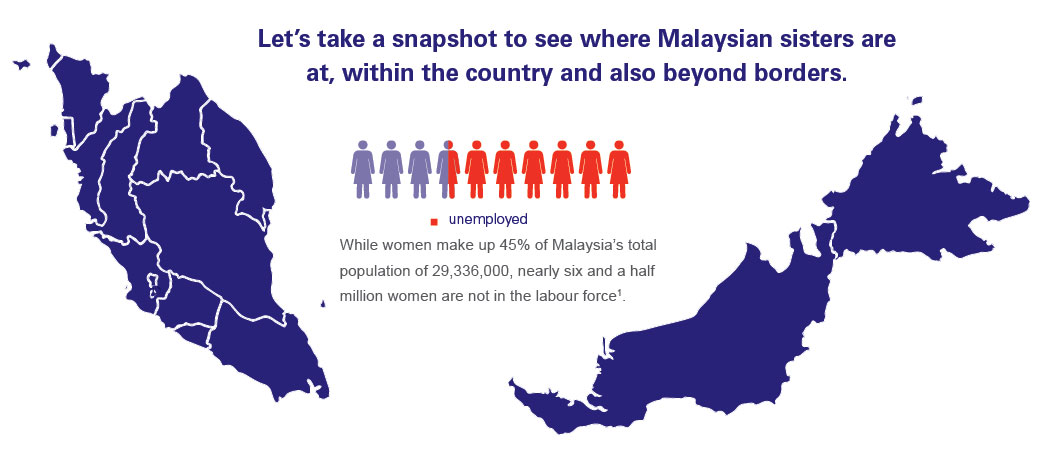

According to World Bank's Malaysian Economic Monitor, the female workforce in Malaysia ranks among the lowest in East Asia lagging behind that of Singapore and Thailand, and significantly lower than those in high income countries 2.

It's hardly surprising that many women still prefer being fulltime mums when their children are young. Just slightly more than half of working-age Malaysian women are participating in Malaysia's labour market with reports citing 52.4% in 20132. The reverse side of the coin suggests that nearly half of them are not in employment.

As they come to the crossroads of giving up their jobs and becoming homemakers, they may have to face a change in lifestyle. Not least among these changes is forgoing their monthly incomes and depending more on their husbands financially. Unless they have substantial savings or spouses with high salaries, those who are so used to their financial independence and freedom, will have to make financial adjustments.

Earning less, living longer

Given the high incidence of women who tend to leave their jobs to be fulltime mums, it pays to heed some pertinent questions:

- Would you be able to retain your lifestyle if you stop or retire from work at an early age?

- How will you manage any change in lifestyle under these circumstances?

- Would financial over-dependence on your partner or family strain your savings?

- How will you fund future needs such as higher education for your children or your own retirement?

- How will you cope financially if you are faced with untoward circumstances such as death or disability of your spouse, divorce, loss of family income, or loss of savings?

Or if your source of financial income ends unexpectedly, how will you manage on your own given the fact that:

On an average, women tend to work fewer years and make less than their male counterparts3. Yet, Malaysian women are also living longer - national statistics showed that the life expectancy in women has risen to 77 years. All over the world women tend to outlive men4. Therefore, it is vital for women to plan ahead to manage their finances to compensate for working fewer years and living longer.

Rising costs, ebbing sources of income

It is just as important to consider another financial reality - the costs of living keep getting higher, not lower5. Especially for those retiring soon, this likely scenario can be pretty daunting. From rentals to utilities, food costs to transport costs, services to education fees, the list goes on. Add that all up and it's easy to see how household income and savings get eaten up.

Ironically for those who are looking forward to retirement, rising costs can easily put a dampener on those plans to reward oneself with a much needed vacation or to take it easy.

If the storms hit, how weatherproof are you?

No one wishes for adverse turns in life. The emotional and financial repercussions have untold effects on lives. Unfortunately, circumstances like a husband retiring with inadequate savings, sudden loss of income, divorce or being struck with disability are not uncommon.

Sadly still, you could be left grappling with an ensuing barrage of setbacks. Rising costs of living, children's higher education needs, medical expenses, insurance payments and house mortgages start appearing on your plate when they were previously your spouse's responsibility. This would knock the wind off anyone's sails no matter how resilient or resourceful a woman can be.

Adding up the future

Before all your multi-roles and multi-tasks take a multi-toll on you, step off that dizzying treadmill of activities and step into your personal banker's office. It is never too early to start planning ahead and wising up on wealth management.

A chat on your next move could prove to be far more valuable than you thought. You can get your risk appetite measured up, your financial expectations calculated, know how much you can grow for the future and how much you can plan for the present.

LIKE THIS ARTICLE?

LIKE THIS ARTICLE?